FinTech

RYT Bank Malaysia Review (2025): Safe, Legal & Earn Up to 4.00% p.a. Daily Interest

Published

2 months agoon

By

Samuel TingDigital banking in Malaysia is evolving faster than ever, with more consumers shifting from traditional branches to AI-powered online banking. Among the new entrants, YTL Digital Bank Berhad – RYT Bank is quickly gaining attention as a strong contender for the best digital bank in Malaysia 2025 — thanks to its high interest rates, low fees, and fully automated app experience.

As Malaysia’s first fully AI-powered bank, RYT Bank offers smarter security, faster onboarding, and real-time financial insights. Many Malaysians are now comparing RYT Bank’s rates and features against Maybank, CIMB, and other established institutions to see whether the RYT Bank interest rate, AI tools, and digital-only model are worth the switch.

This guide breaks down everything you need to know about RYT Bank Malaysia, including its safety, regulation, interest rates, features, fees, and how it compares to other digital banks in Malaysia.

If you’re comparing RYT with GXBank specifically, we’ve reviewed GXBank in detail here: GXBank Honest Review (2025).

Quick Answer — Is RYT Bank Good for Malaysians?

TL;DR — Should Malaysians Use RYT Bank?

- Yes — it’s regulated under Bank Negara Malaysia.

- Up to 4.00% p.a. with daily interest crediting.

- RYT Card offers 0% FX fees (promo) + 1.2% unlimited overseas cashback.

- Local debit card rewards: 1.2% cashback (capped at RM12) via MyDebit transactions.

- ATM fee waiver: first 2 domestic ATM withdrawals per month are free.

- PayLater: 0% interest for the first month + flexible 3/6/9/12-month instalments.

- If the first repayment is missed, RYT auto-converts to a 3-month instalment (no late fees).

- Best for Malaysians who want high interest, travel perks, cashback, and smart AI banking.

Table of Contents

- What Is RYT Bank? (Malaysia’s First Fully AI-Powered Bank)

- The Powerhouse Backing RYT Bank (YTL Group × Sea Limited)

- Is RYT Bank Safe & Legal in Malaysia?

- RYT Bank Key Features

- RYT Bank Products & Features (2025)

- RYT Bank Fees & Charges

- RYT Bank Interest Rates Summary

- How to Open an RYT Bank Account

- Pros & Cons of RYT Bank

- RYT Bank vs Traditional Banks in Malaysia

- RYT Bank vs Other Digital Banks in Malaysia (2025)

- FAQs — RYT Bank Malaysia

- Final Verdict: Should Malaysians Use RYT Bank?

What Is RYT Bank? (Malaysia’s First Fully AI-Powered Bank)

RYT Bank enters the market as one of the most advanced digital bank Malaysia 2025 offerings, designed for users who prefer smart, mobile-first financial tools. RYT Bank has been widely covered by major Malaysian outlets such as The Star, The Edge, and iMoney, highlighting its AI-first approach to onboarding, security, and automation.

Unlike conventional online banks that simply move existing services onto an app, RYT Bank integrates end-to-end AI automation — from onboarding and fraud detection to personalised financial insights and automated savings optimisation. This makes RYT Bank one of the most advanced financial platforms in the region, offering Malaysians a seamless, intelligent banking experience powered entirely through mobile.

The Powerhouse Backing RYT Bank

To build trust immediately with Malaysian users, RYT Bank is created through a strategic joint venture between two giants:

✔ YTL Group (Malaysia)

A respected Malaysian conglomerate with decades of experience in utilities, telecommunications (YES 5G), infrastructure, and digital transformation.

✔ Sea Limited

The parent company of Shopee and Garena, two of Southeast Asia’s most influential technology brands.

According to reports from The Edge Malaysia and The Star, the joint venture between YTL Group and Sea Limited is one of the most significant technology–finance collaborations in Malaysia’s digital banking rollout. It is giving RYT Bank unmatched credibility, financial stability, and innovation capability.

Is RYT Bank Safe & Legal in Malaysia?

RYT Bank is designed to meet Malaysia’s strict digital banking regulations and incorporates strong security controls to protect users. Here’s a detailed breakdown of its safety profile.

Sources Referenced in This Section

1. Regulatory Compliance (Bank Negara Malaysia)

RYT Bank operates under the Bank Negara Malaysia Digital Banking Framework, following rigorous standards for governance, risk management, capital requirements, and customer protection.

This ensures:

- compliance with financial laws

- oversight by Malaysia’s central bank

- transparent operations under a licensed framework

RYT Bank operates under the Bank Negara digital banking license guidelines, ensuring full compliance with governance, capital, and consumer protection standards.

2. Security & Fraud Protection (AI-Driven)

RYT Bank uses advanced security systems powered by AI, including:

- Two-factor authentication (2FA)

- Biometric login (face ID / fingerprint)

- AI-powered fraud detection in real time

- End-to-end encrypted data

- Device binding for app access

These layers protect accounts from unauthorized access, fraud, and identity theft.

3. Deposit Safety (PIDM Coverage)

Deposits may be insured up to RM250,000 per depositor if placed with a PIDM member bank under RYT Bank’s operational structure.

This provides:

- protection during bank failure

- guaranteed reimbursement up to RM250k

- confidence for savings and emergency funds

(Always check the latest coverage on RYT’s website as digital banks often partner with licensed banks for PIDM protection.)

Verdict: Is RYT Bank Safe?

Yes.

RYT Bank meets BNM’s digital banking requirements, uses strong AI-driven security measures, and may offer PIDM protection through partner structures. Combined with the backing of YTL Group and Sea Limited, it is a trustworthy option for Malaysians seeking a secure digital bank.

RYT Bank Key Features

RYT Bank focuses on giving Malaysians a smarter, more flexible way to save, spend, and borrow:

-

-

- Mobile-first savings with high interest via RYT Save Pockets

- RYT AI for smart financial insights, spending analysis, and automated savings

- PIDM-insured deposits up to RM250,000 per depositor (via partner bank)

- Instant transfers via DuitNow & QR Pay

- Switchable debit/credit Visa card with 0% FX (promo) and 1.2% unlimited overseas cashback

- Local debit rewards: 1.2% MyDebit cashback (RM12 cap for campaign period)

- Integrated PayLater with 0% interest for the first month + flexible 3/6/9/12-month instalments

- ATM fee waiver: first two (2) domestic ATM withdrawals per month are free

- Make instant cashless payments using DuitNow QR nationwide

-

What Is RYT AI?

RYT AI is the bank’s built-in artificial intelligence engine that powers security, insights, and automation across the entire app. It helps users manage money smarter and safer.

-

-

-

- AI Security: Real-time fraud detection, behavioural monitoring, and device risk scoring.

- AI Insights: Automated spending analysis, bill reminders, and personalised saving suggestions.

- AI Automation: Daily interest optimisation, round-up savings, and auto-categorisation of transactions.

- AI Rewards: RM1 cashback per eligible transaction (new)

-

-

RYT Bank Products, Features & Rewards (Malaysia, 2025)

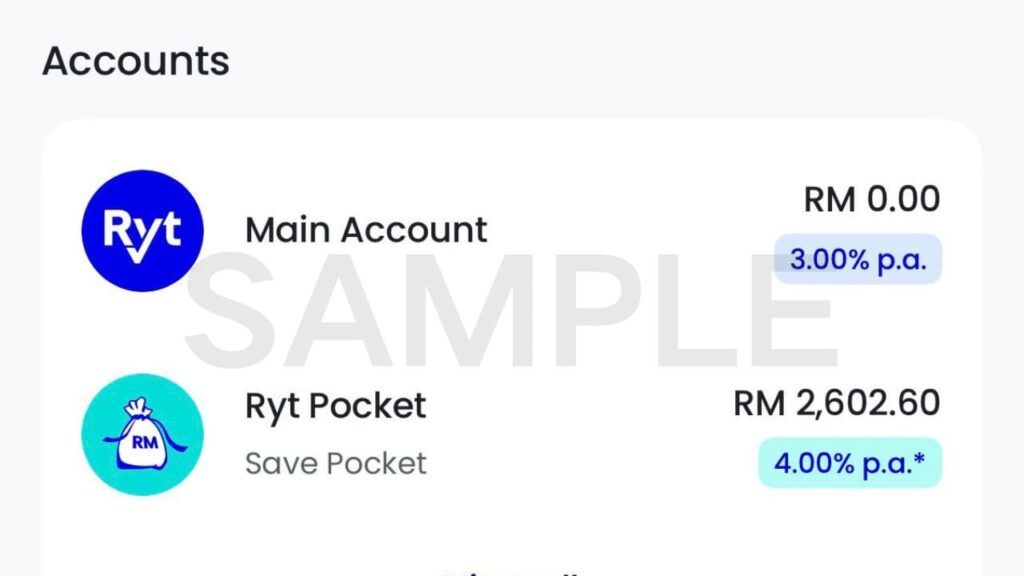

A. Savings Account & Interest Rate

One of the biggest reasons Malaysians are switching to RYT Bank is its strong suite of digital products — including the high-interest RYT Save Pockets, the dual-function RYT Card, and the flexible RYT PayLater facility. These features are powered by AI-based optimisation and daily interest calculations to help Malaysians save, spend, and borrow more efficiently.

If you’re comparing returns beyond digital savings, you can also check our guide on the best fixed deposit rates in Malaysia for more long-term options.

1. Daily Interest Crediting (Standout Feature)

RYT Bank calculates interest every single day and credits it once the accrued amount reaches RM0.01. This makes your savings grow faster compared to traditional banks that only credit monthly interest.

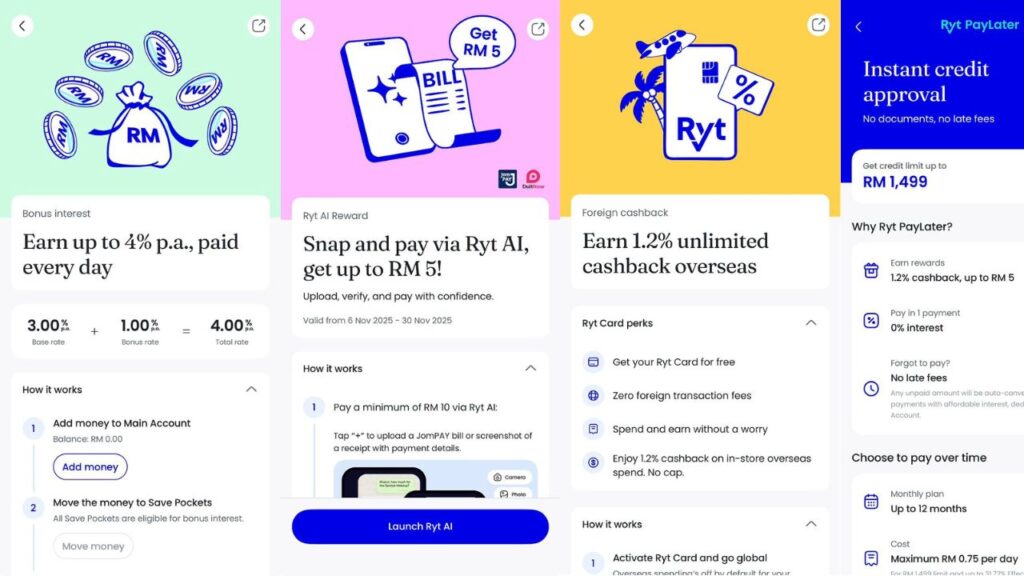

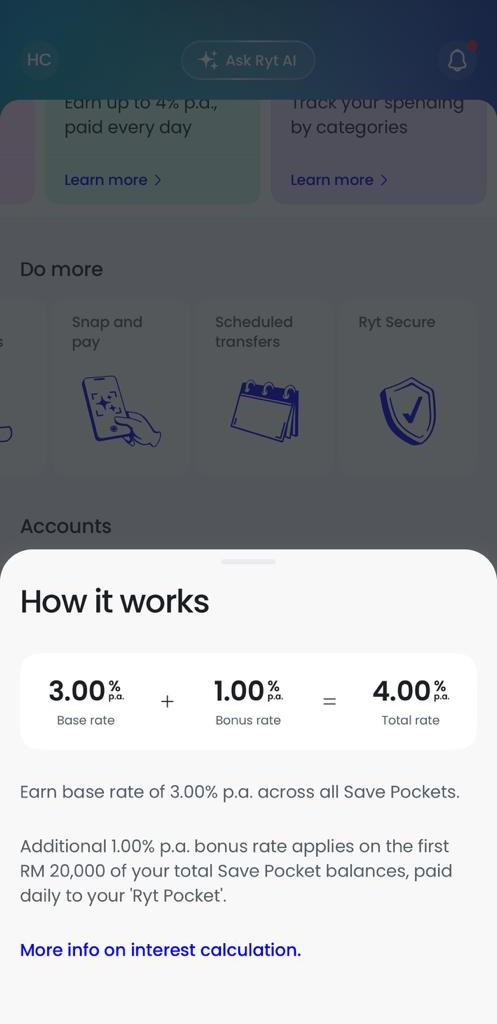

2. Updated RYT Save Pockets Promo: Earn Up to 4.00% p.a. (Daily)

RYT Bank’s latest savings campaign allows users to earn a 3.0% base rate plus a 1.0% bonus rate after completing simple qualifying transactions.

| Rate Type | Percentage | Requirements |

|---|---|---|

| Base Rate | 3.0% p.a. | Applies to both Main Account and Save Pockets |

| Bonus Rate | +1.0% p.a. | Collect 5 Stamps (min RM10 per transaction) |

| Total | 4.0% p.a. | Applies to first RM20,000 across all Save Pockets |

⚠ Promo “Gotchas” to Know (Updated 2025–2026)

- 4.00% p.a. applies only to the first RM20,000 across all Save Pockets.

- Promo ends on 31 March 2026.

- You must collect 5 stamps to unlock the bonus rate.

- 1 stamp = 1 eligible transaction (min RM10).

- Only 1 stamp per day is counted.

- The 30-day bonus period starts the day you collect your 5th stamp.

- Every new 5 stamps will reset and extend your 30-day bonus period.

- Eligible transactions include RYT Card spends and JomPAY payments.

3. No Lock-In Period

There is no fixed tenure, no penalty for early withdrawal, and no minimum period required. You can move funds in and out of Save Pockets instantly — ideal for emergency funds, short-term savings, and fast-growing deposits.

B. RYT Card (Visa Debit + Credit Combo)

The RYT Card is one of Malaysia’s first dual-function Visa cards, combining both debit and credit functionalities within a single physical card — all controlled through the RYT Bank app.

1. Switchable Debit/Credit Modes

You can enable or disable debit and credit modes instantly through the app. This gives you full flexibility for:

-

-

- Daily spending (debit)

- Overseas transactions (credit)

- Online purchases (switchable for security)

-

2. Travel Perk: 1.2% Unlimited Cashback + Zero FX Fee

RYT Bank now offers a powerful overseas spending campaign:

-

-

- 1.2% Unlimited Cashback on all Eligible Overseas Transactions

- 0% foreign transaction fee during the campaign period

- Valid worldwide through the Visa network

-

Campaign Period: 18 August 2025 – 31 March 2026

Eligibility: All RYT Bank customers with an active RYT Debit Card.

A great advantage for Malaysians who want a fully digital bank but still need occasional cash access. For travellers who want even more perks, you may also consider our list of the best credit cards with free airport lounge access in Malaysia.

3. ATM Fee Waiver Campaign (Updated)

RYT Bank now offers a limited ATM fee waiver campaign instead of unlimited free MEPS withdrawals. Eligible customers can enjoy waived fees under the following conditions:

| Fee Waiver | Requirement |

|---|---|

| Domestic ATM Withdrawal Fee (Up to 2 free withdrawals per month) |

You must perform a cash withdrawal at a domestic ATM using your physical Ryt Card. The first two (2) domestic ATM withdrawals each calendar month are free. Subsequent withdrawals will be charged according to the Fees & Limits page. |

| Overseas Transaction Fee (Card-present only) |

You must make an overseas transaction at a card-present terminal using your Ryt Card. Online / card-not-present overseas transactions are not eligible for this waiver. |

Important Notes:

- Fee waivers are subject to RYT’s campaign period and T&Cs.

- Campaign ends on 31 March 2026.

- Online overseas transactions still incur standard FX + network charges.

- Domestic ATM fee waiver resets monthly.

4. New Local Cashback Reward (MyDebit 1.2% Cashback Campaign)

RYT Bank has introduced a new cashback campaign for domestic MyDebit transactions using the physical RYT Card.

-

-

- 1.2% Cashback on Eligible MyDebit retail transactions

- Campaign period: Until 31 December 2025

- Cashback cap: RM12.00 for the entire campaign period

- Valid only for physical card transactions routed through MyDebit

-

Eligible Transactions include:

-

-

- Retail transactions at participating MyDebit merchants in Malaysia

- Transaction must be processed via MyDebit network

-

Excluded: Any transaction falling under excluded Merchant Category Codes (MCC) listed by RYT Bank.

Important Notes:

- Total cashback cap is RM12 only for the whole campaign period.

- Virtual card transactions are not eligible.

C. RYT PayLater (Updated 2025)

RYT PayLater is RYT Bank’s built-in “buy now, pay later” (BNPL) facility that allows Malaysians to split purchases into convenient monthly instalments. It comes with 0% interest for the first month and flexible repayment options thereafter.

1. 0% Interest for the First Month

All approved PayLater transactions enjoy 0% interest for the first billing month. This makes RYT PayLater suitable for short-term borrowing without extra charges.

2. Flexible Instalment Options (After First Month)

After the 0% interest month ends, users can convert the remaining balance into one of the following instalment plans:

-

-

- 3 months

- 6 months

- 9 months

- 12 months

-

The interest rate for instalment plans varies and will be shown clearly in the RYT app before confirmation.

3. Automatic Conversion If You Miss the First Payment

If you do not settle the full amount by the first month’s due date, RYT will:

-

-

- automatically convert the outstanding amount into a 3-month instalment plan

- deduct repayment from your main savings account

- not charge late fees

-

4. No Late Fees

RYT Bank does not charge any late fees or penalty fees. However, interest will apply once the instalment conversion begins.

5. Where You Can Use PayLater

You can use RYT PayLater at:

-

-

- Authorised merchants approved by RYT Bank

- Selected online and offline channels

- Transactions in Ringgit and permitted foreign currencies

-

Your Approved Limit and Available Limit will be displayed in the RYT Bank app.

D. RYT AI Reward Campaign (RM1 Cash Reward)

RYT Bank now offers a new reward programme where customers can earn RM1 cashback each time they perform an Eligible Transaction using the Ryt AI feature.

Quick Summary — RYT AI Reward

- RM1 cashback for each Eligible Transaction

- Minimum RM10 per transaction

- Maximum 1 reward per day

- Maximum 5 rewards per campaign (RM5 total)

- Reward is usually credited instantly

- May take up to 15 business days in exceptional cases

Eligible Transactions (Must Use Ryt AI)

-

-

- External Transfer

Transfer from RYT Bank to another local bank using RYT AI. - Intrabank Transfer (P2P)

Transfer to another RYT user (not your own accounts). - Bill Payments via JomPAY

Upload bill screenshot → Ryt AI extracts details → Auto JomPAY payment.

- External Transfer

-

Transactions That Do NOT Qualify

-

-

- Transfers between your own RYT accounts (Main → Pocket, Pocket → Pocket)

- Transactions below RM10

- Bill payments done outside the Ryt AI tool (e.g., via TNB app, Unifi app)

-

✔ Sending RM20 to a friend’s Maybank account → RM1 reward

✔ Sending RM30 to a friend’s RYT account → RM1 reward

✘ Sending RM5 to a friend → No reward

✘ Moving money to your own Save Pocket → No reward

✔ Paying TNB via JomPAY using Ryt AI → RM1 reward

✘ Paying Unifi through the Unifi app → No reward

RYT Bank Malaysia savings dashboard featuring daily interest crediting on Save Pockets.

RYT Bank Fees & Charges (Malaysia)

| Service | Fee |

|---|---|

| Account opening | RM0 |

| Monthly fees | RM0 |

| DuitNow transfers | RM0 |

| Local transfers | RM0–RM1 |

| MEPS ATM withdrawals | 2 free withdrawals/month (campaign) |

| Foreign currency FX fee | 0% (promo) |

RYT Bank Interest Rates Summary

| Product | Interest Rate |

|---|---|

| Save Pockets | Up to 4.00% p.a. |

| Savings Base Rate | 3.00% p.a. |

| Bonus Rate | +1.00% p.a. (first RM20k) |

How to Open an RYT Bank Account

-

-

- Download RYT Bank app

- Register with mobile & email

- Complete eKYC (What you need: MyKad, active mobile, liveness scan)

- Verify identity

- Deposit funds

- Start using your account instantly

-

Setup takes 5–7 minutes.

Pros & Cons of RYT Bank

| ✔ Pros | ✘ Cons |

|---|---|

| Malaysia’s First Fully AI-Powered Bank Integrates AI in onboarding, fraud detection, insights, and automation. |

New Player in Digital Banking Still building long-term trust and product maturity. |

| Up to 4.00% p.a. Interest Save Pockets offer high daily interest with promo bonus. |

Interest Promo Is Time-Limited Bonus rate ends 30 Nov 2025 and applies only to first RM20k. |

| Daily Interest Crediting Faster interest growth compared to monthly-crediting banks. |

Some AI Features Still in Beta Not all smart recommendations and tools are fully rolled out. |

| Free MEPS ATM Withdrawals Up to 2 free domestic ATM withdrawals per month (campaign-based) |

No Physical Branches Digital-only support may not suit users preferring in-person help. |

| 0% FX Fees + Cashback Excellent for travellers with unlimited overseas cashback. |

Small PayLater Limit Max RM1,499 may be too low for larger spending needs. |

| Cashback via Using RYT AI RM1 cashback reward via RYT AI (up to 5 rewards) |

Promotions May Change Rates, cashback, and perks may adjust after launch period. |

RYT Bank vs Traditional Banks in Malaysia

| Feature | RYT Bank | Traditional Bank |

|---|---|---|

| Interest rate | Higher | Moderate |

| FX fees | 0% | 1–2% |

| ATM access | 2 free withdrawals/month (campaign) | RM1–RM2 |

| AI automation | Full | Limited |

RYT Bank wins for digital convenience and high yield, while traditional banks still win for branch support.

RYT Bank vs Other Digital Banks in Malaysia (2025)

Here is a quick comparison between RYT Bank and other major digital banks in Malaysia, based on interest rates, card perks, and Islamic banking availability.

| Feature | RYT Bank | Boost Bank | GXBank | AEON Bank |

|---|---|---|---|---|

| Interest Rate | Up to 4.00% p.a. | 3.30% p.a. | 3.00% p.a. | 3.00% p.a. |

| Interest Crediting | Daily | Daily | Daily | Daily |

| Foreign Transaction Fees | 0% (promo) | 1%–2% (typical) | 1%–2% (typical) | 1%–2% (typical) |

| ATM Access | 2 free withdrawals/month (campaign) | No card yet | No card yet | Debit Card (AEON ATMs + MEPS) |

| Card Availability | Visa Debit + Credit Combo | Not launched | Not launched | AEON Debit Card |

| PayLater / Credit | Yes (up to RM1,499) | Boost PayLater (via Boost app) | None | AEON Wallet instalments (limited) |

| PIDM Coverage | Yes (via partner bank) | Yes | Yes | Yes |

| Best For | Highest interest + AI card features | Boost eWallet users | Grab ecosystem users | Cashback lovers + AEON shoppers |

Looking for a full comparison? Check out our complete guide:

Best Digital Banks in Malaysia (2025) – Rates, Features & Safety Comparison.

FAQs — RYT Bank Malaysia

What is the interest rate for RYT Bank’s savings account?

RYT Bank offers up to 4.00% p.a. (3.00% base + 1.00% bonus on first RM20,000). The current promotional campaign runs until 31 March 2026.

Is RYT Bank legal in Malaysia?

Yes. RYT Bank operates under Bank Negara Malaysia’s Digital Banking Framework and is backed by YTL Group and Sea Limited.

Is RYT Bank safe?

Yes. It uses bank-grade security, AI fraud monitoring, 2FA, encryption, and biometric authentication. Deposits may be protected up to RM250,000 if held under a PIDM member partner bank within RYT Bank’s structure.

Does RYT Bank support DuitNow?

Yes — it supports DuitNow ID linking, transfers, and DuitNow QR payments.

What is the RYT Card?

A single Visa card with dual functionality — you can switch between debit and credit modes in the app. It also offers 0% FX fees (promo) and unlimited cashback on overseas spending.

Does RYT Bank have Islamic banking?

Not yet. There has been no official announcement of Islamic-compliant accounts.

Does RYT Bank offer free ATM withdrawals?

RYT Bank offers two (2) free domestic ATM withdrawals per month under its fee waiver campaign. Additional withdrawals will incur standard ATM network fees.

What is RYT AI?

RYT AI is RYT Bank’s built-in artificial intelligence engine that powers smart features such as spending insights, automated savings, real-time fraud detection, transaction categorisation, and personalised financial recommendations. It helps Malaysians manage money more efficiently with minimal manual input.

Does RYT Bank offer rewards for using Ryt AI?

Yes. RYT Bank currently offers a Ryt AI Reward campaign where users can earn RM1 cashback for each eligible transaction performed through the Ryt AI feature. Minimum RM10 per transaction. Limited to 1 reward per day and 5 rewards per campaign.

Final Verdict: Should Malaysians Use RYT Bank?

RYT Bank is one of the most compelling digital banking options in Malaysia for 2025. With high interest rates, AI-powered features, daily interest crediting, free ATM withdrawals, and strong travel perks, it offers more value than most traditional banks. Backed by YTL and Sea Limited, it delivers both innovation and trust — making it especially attractive for young professionals, students, digital natives, online shoppers, and frequent travellers.

If you want a fast, smart, and flexible digital banking experience, RYT Bank is absolutely worth trying.

Sources & References

Information in this review is supported by publicly available data from reputable Malaysian financial and news outlets, including:

-

-

- Bank Negara Malaysia (BNM) — Digital Banking Framework and regulatory guidelines

- PIDM Malaysia — Deposit protection structure and RM250,000 coverage information

- The Star — Coverage on Malaysia’s digital banking landscape and new bank launches

- The Edge Malaysia — Reports on YTL Group and Sea Limited’s digital bank joint venture

- iMoney Malaysia — Comparisons and analysis of Malaysian digital banking products

- RYT Bank Official Website — Product features, interest rates, and promotional terms

-

All financial rates and promotional details are accurate at the time of writing. Users are encouraged to check the latest updates directly on the bank’s official website.

Why are Young Professionals Choosing a 2 BHK Flat for Sale in Bangalore?

What is the role of Indian payment gateways in driving e-commerce growth?

Why Restaurant Iftars Are Becoming a Preferred Ramadan Choice

Using MT5 to Combine Technical Analysis, Market Depth, and Order Flow

Car Insurance Policy Basics: Key Terms Every Car Owner Should Understand

What Is Travel Insurance and How Does It Work When You’re Abroad?

What is Balance Transfer for Credit Card in Malaysia (2026)

Pivots to Your Technical Business That Just Make Sense Heading Into 2026

When to Use Antihistamine Eye Drops: A Guide to Allergy Eye Relief