FinTech

Online Loan vs. Personal Loan : 10 Facts Malaysian Need to Know

Published

5 months agoon

By

Samuel TingIf you’ve ever looked into borrowing money, you’ll know the struggle: online loan, personal loan, fast loan, direct lending—banks just love throwing fancy terms around. It’s like they invented a dictionary just to confuse us.

But here’s the truth: not all loans are created equal. And if you want to avoid overpaying or getting stuck with the wrong loan type, it’s worth learning what these terms actually mean.

Problem is, most forums and blog comments are filled with noise—and sifting through all of them can drive anyone nuts. That’s exactly why we’re here.

Whether you’re applying for a personal loan in Malaysia or browsing for the best online loan interest rate, we’ve got your back. Let’s cut through the jargon and show you 10 surprising things your banker never told you about online and personal loans.

1. Fastest Online Loan in Malaysia? Think GX Bank FlexiCredit

GX Bank offers a GX Bank Online Loan—FlexiCredit—where funds hit your account within minutes after approval. Interest starts at 3.78% p.a., with effective interest ~6.45%. You draw from your limit whenever needed, with zero early settlement or processing fees. Easily accessed via their website and app, their customer service is responsive as well. Personally speaking, it’s overall a smooth user experience to deal with GX bank.

2. Online loan Malaysia often beats banks on speed

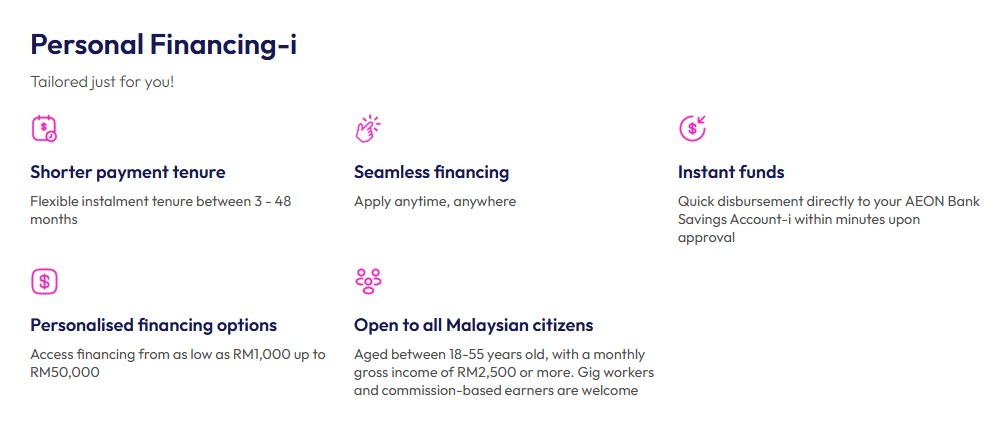

Unlike the 1–3 day wait for traditional loans, online loans like GX FlexiCredit or Aeon Bank Personal Financing-i can get money to your account within minutes. For emergencies, online is the way to go.

3. Who’s Eligible?

- GX Bank: Malaysians aged 21–64 with income ≥ RM1,500, salaried or self-employed

- Aeon Bank: Applicants aged 18–55 earning ≥ RM2,500—including gig and commission earners

Both are designed for easy application, no guarantor or collateral needed.

4. Online Loan Size & Flexibility

| Loan Type | Loan Range (RM) | Tenure | Flexibility |

| GX Bank FlexiCredit | 1,000–150,000 | 6–60 months | Multiple drawdowns, flexible repay |

| Aeon Bank PF-i | 1,000–50,000 | 3–48 months | Fixed drawdown, flexible tenure |

| Traditional Bank Loans | 5,000–250,000+ | 1–10 years | Standard personal loans |

FlexiCredit stands out for immediate drawdowns. Aeon Bank’s digital loan is speedy but less flexible.

*Drawdown: Withdrawing money from your approved loan limit as you don’t have to take the full amount all at once. The interest will only be charged on the amount you’ve used, not the whole limit.

5. Interest and Profit Rates

- GX FlexiCredit: Flat 3.78% p.a., EIR about 6.45%

- Aeon Bank PF-i: Flat profit from 0.66% per month (~7.9% p.a.)

- Traditional personal loans: Rates vary, often 3.99% flat upwards.

Online loans can be slightly pricier short-term, but offer unmatched convenience.

6. Speed vs Stability Trade-off

- Online loan Malaysia: Up to RM150k, funds in minutes, zero early repayment fees, ideal for emergencies.

- Personal loan: More thorough vetting, takes days but offers lower effective rates and is suited for larger financing.

Tips: Use GX FlexiCredit to cover urgent bills—money landed in the next bank cycle. Later, refinance it via a bank loan for better rates. Pay less interest monthly, and credit score will improve from timely repayments.

7. Paperwork and Application Process for Online Loan vs. Personal Loan

- GX Bank: Apply entirely via app. For salaried, submit EPF statements; for self-employed, bank statements. Done in minutes.

- Aeon Bank PF-i: Digital form, upload ID and income docs. Approval occurs in-app, funds same day to Aeon Savings-i

- Bank Loans: Often require hard copies, proof of employment, and take up to a week.

Online apps make it smoother and faster.

8. Who Should Choose an Online Loan in Malaysia?

- Emergency expenses like urgent repairs or medical bills.

- Freelancers or small business owners needing quick cash.

- Borrowers want transparent digital service with minimal overhead.

Flexibility and speed are unbeatable perks.

9. When Personal Loans Work Better

- If you need a high amount (RM100k+).

- Prefer longer repayment periods (up to 10 years).

- Prefer the lowest possible interest and payment predictability.

- Don’t mind waiting a few days.

Think renovation budgets or debt consolidation—these benefit from bank loan structure.

10. Hidden Truths Not Often Shared

Online loan Malaysia platforms highlight transparency—but always check:

- Are variable withdrawal fees involved?

- Is the interest truly flat, or is there an EIR twist?

- Will multiple withdrawals rack up fees over time?

GX Bank’s multiple drawdown model is helpful, but it’s vital to track usage to avoid surprises.

Pros and Cons of Loans

| Feature | Online Loan (GX/Aeon) | Personal Loan (Bank) |

| Approval Time | Minutes to same day | 1–7 days |

| Loan Amount | RM1k–150k | RM5k–250k+ |

| Repayment Tenure | Up to 60 months | Up to 120 months |

| Early Repayment Fees | Rarely, often none | Depends—check early settlement fees |

| Interest Rate | 3.78%–7.9% p.a. | From ~3.99% flat |

| Application Mode | Fully online | Mix of online and offline |

| Transparency | Clear, app-based | May include more hidden terms |

Takeaway: What Fits Your Needs?

If you need quick access, minimal hassle, and are comfortable with shorter tenures, go for an online loan Malaysia solution like GX Bank FlexiCredit or Aeon Bank Personal Financing-i.

But if you’re managing larger sums, planning for the long haul, and want the lowest interest, a personal loan from a reputable bank is still the go-to.

Both are powerful tools—when used smartly. Choose based on speed, amount, and repayment flexibility that match your life. That’s how you avoid financial headaches down the line.

FAQs

Q: Can online loans hurt my credit score?

A: If paid on time, they help—as long as they report to CCRIS. Just don’t default or apply repeatedly.

Q: Are flexible drawdowns really helpful?

A: Yes. You only pay interest on what you draw. But discipline is key.

Q: Do Aeon Bank loans cost more than GX Bank’s?

A: Aeon’s flat profit can be higher than GX’s low rate, but comes with flexible tenure and access for freelancers

Q: Will online loans show up on my bank loan?

A: Yes—they’re usually reported, so your overall debt ratio matters.

Q: Can I refinance an online loan into a personal loan?

A: Absolutely—and it’s smart. Start fast, then refinance into cheaper long-term credit.

Comparing Traditional Loan Options vs Crypto Financing in Malaysia

Eczema, Psoriasis, and Allergies in Winter: Understanding Triggers and Treatments

Tip to Benefit Maximally From Your Tow Truck Course

Esports Arena Network Design: 1,000‑Seat LAN & AV Setup (2025 Guide)

Why Jeep Owners Are Switching to Automatic Tops Like eTop

Comparing Demat Account Providers: Which One Should You Choose?

How Anti‑Cheat SDKs Work (Kernel vs User Mode)

NDI vs SRT vs RTMP (2025): Which Stream Protocol Gives You the Lowest Latency for Esports Broadcasts?

New 240Hz 1440p Panels: What Changes for Players