FinTech

Best 5 Fast Personal Loans in Malaysia 2025

Published

5 months agoon

By

Samuel Ting  If you need a fast loan in Malaysia today, you’re not alone. Life happens—unexpected bills, last-minute travel, or even a renovation project that can’t wait. Luckily, 2025 offers some solid personal loan options with fast approval and minimal fuss. I’ve tested a few myself, and I’m breaking them down for you here—with the real pros, cons, and things I wish I knew earlier.

If you need a fast loan in Malaysia today, you’re not alone. Life happens—unexpected bills, last-minute travel, or even a renovation project that can’t wait. Luckily, 2025 offers some solid personal loan options with fast approval and minimal fuss. I’ve tested a few myself, and I’m breaking them down for you here—with the real pros, cons, and things I wish I knew earlier.

And if you want to prep yourself with some information for a newbie with minimal knowledge about personal loan, we’re here to serve. Check out our article about Who should get a personal loan in Malaysia for everything you need to know

⚡ What Makes a Fast Loan Truly Fast?

Fast loan approval isn’t just marketing fluff. It means applying today and possibly seeing money in your account within 24 to 48 hours. These are personal loans with fast approval that actually show up when you need them—without the usual paperwork marathon.

Overview of Fast Loan in Malaysia

| Lender | Interest Rate (p.a.) | Tenure | Disbursement Time | Max Loan (RM) |

| Tambadana | Up to 18% flat | Up to 1 year | 5 minutes | 10,000 |

| Alliance Bank | 4.99% to 16.68% p.a. | 1–7 years | Within 24 hours | 200,000 |

| CIMB Cash Plus | From 4.38% flat | Up to 5 years | Instant | 100,000 |

| GX FlexiCredit | From 3.78% p.a. | 6 months to 5 years | Instant | Custom |

| instaDuit | 12%-18% p.a. | 6 months to 4 years | 1-2 days | 10,000 |

🏆 1. Tambadana – Instant, No-Fuss

Why it stands out: 5-minute approvals, same-day disbursement. Perfect if you’re in a jam and need cash, like, now.

- Loan amount: RM500 to RM10,000

- Tenure: Up to 1 year

- Flat rate: Up to 18%

My take: I borrowed RM8,000 for a medical emergency. Got it within the hour. The short tenure and rate made repayments steep, but it saved the day.

Watch out for: Higher interest if you stretch the loan, and a strict short-term cap.

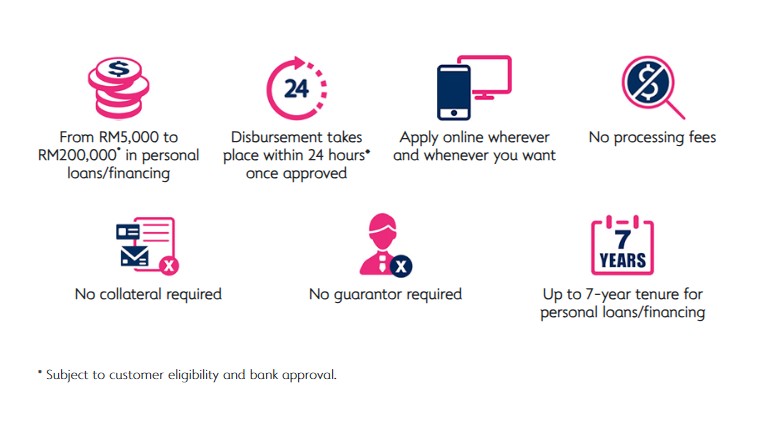

2. Alliance Bank Digital – Smart & Rewarding

- Flat rate: 4.99% to 16.68% p.a.

- Tenure: 1 to 7 years

- Loan size: RM5,000 to RM200,000

- Disbursement: Within 24 hours

Perks:

- 30% cashback on interest

- No collateral required

- Fully digital process

Real case: My cousin got RM30k in two hours. She even earned cash back—felt like the loan paid her back.

Good for: Those planning bigger expenses with a need for both speed and flexibility.

3. CIMB Cash Plus – Instant & Clean Fast Loan

- Rate: From 4.38% p.a.

- Features: Instant online approval, no fees, no collateral

- Loan tenure: Up to 5 years

Why it’s reliable: I was approved for RM20k in ten minutes. No sneaky charges or back-and-forth.

Heads up: Effective interest rate (EIR) is closer to 8%, so always check the real cost.

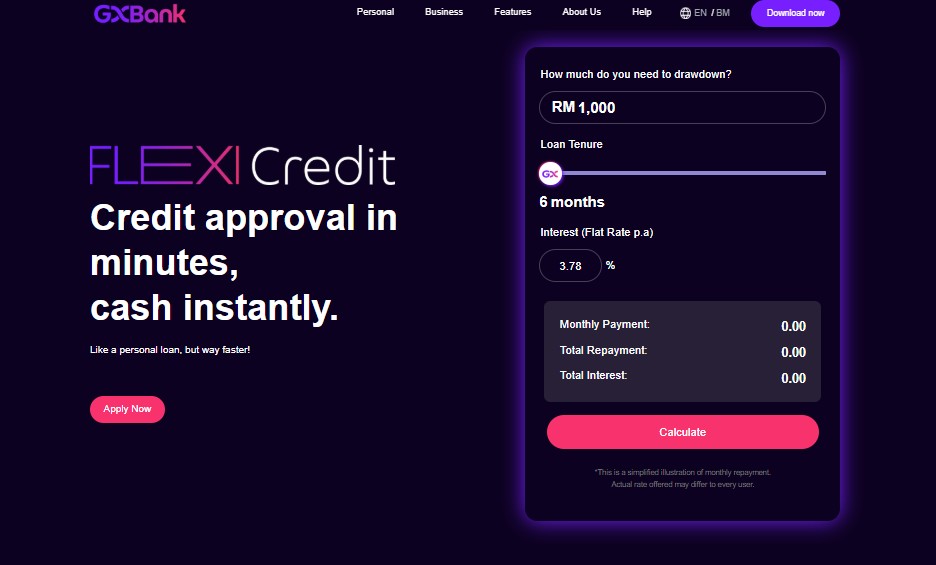

4. GX FlexiCredit – Low-Income Friendly

- Interest: From 3.78% p.a.

- Target: Salaried workers earning RM1,500+

- Disbursement: Fast-track via mobile app

Ideal for: First-time borrowers and lower-income applicants. Less red tape, transparent terms.

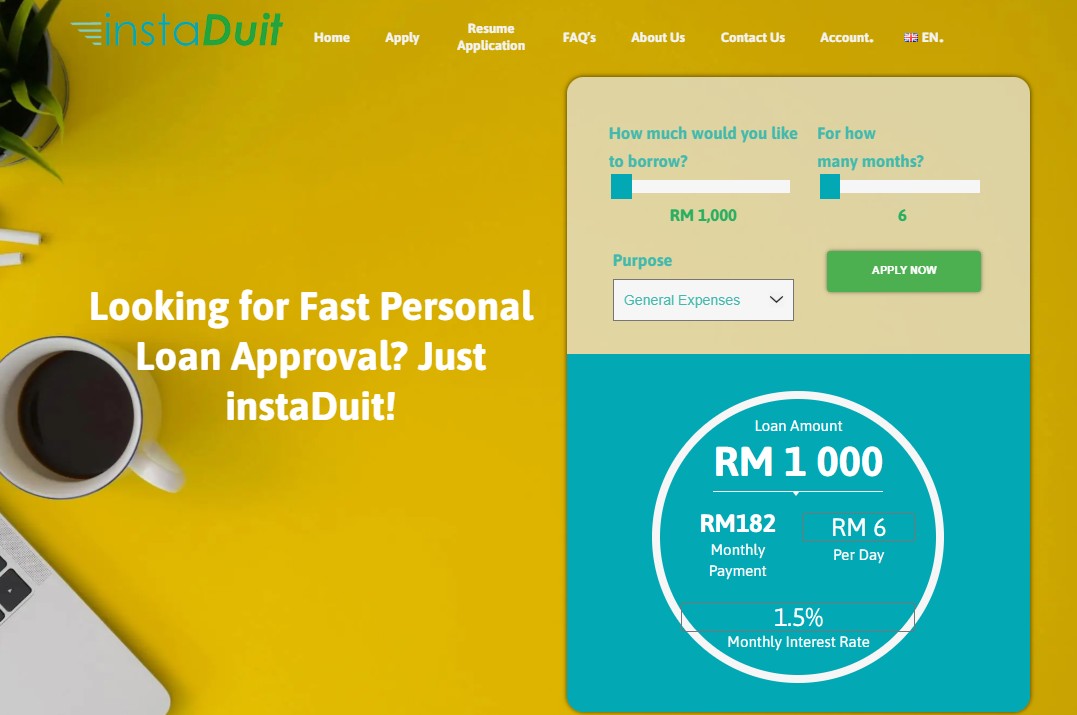

5. instaDuit – Licensed & Lightning Fast

- Rate: 12% to 18% p.a.

- Loan range: RM1,000 to RM10,000

- Disbursement: 1-2 days

Why people use it: Licensed under KPKT (Ministry of Housing and Local Government), minimum documents needed (MyKad, payslip).

Tradeoff: Higher rates than banks, but very fast turnaround.

📊 Pros and Cons at a Glance

| Lender | ✅ Pros | ⚠️ Cons |

| Tambadana | Ultra-fast, simple, same-day pay | Small amount, high short-term rate |

| Alliance Bank | Low rate, cashback, flexible tenure | Requires decent credit history |

| CIMB Cash Plus | No fees, fast approval, transparent | Requires decent credit history |

| GX FlexiCredit | Low income accepted, clear process | Smaller max amount |

| instaDuit | Very fast, minimal docs needed | Higher interest, short tenure |

📊 My Loan Journey Snapshot

I once borrowed RM8k from Tambadana for a surprise overseas trip. Approval took 5 minutes. A month later, I refinanced with Alliance Bank to stretch repayment to 3 years—flat 5.5%, with cashback. My monthly payments dropped from RM1,400+ to under RM300. That move saved me nearly RM300/month.

💡 Tips You Won’t Hear Elsewhere

1. Flat vs Effective Rate

Flat rates sound low but often hide compound interest. Always calculate the effective interest rate (EIR).

2. Check Your Credit First

Before applying, use CTOS or CCRIS to check your credit score. Better score = better rates.

3. Refinance Smart

Use short loans like Tambadana to handle emergencies, then shift to long-term options like Alliance or CIMB.

4. Avoid Loan Overlaps

Two fast loans? That’s a shortcut to a debt spiral. Keep one at a time.

5. Pay Off Early

Banks like CIMB and Alliance don’t penalize early settlement. Take advantage if you can.

🧠 FAQs: Fast Loans in Malaysia 2025

Q: What’s the fastest loan approval in Malaysia right now?

A: Tambadana offers approval within 5 minutes and funds the same day.

Q: Can I refinance a fast loan?

A: Yes—once your situation stabilizes, refinance to a longer-term loan with lower rates.

Q: Which loan is best for low-income earners?

A: GX FlexiCredit (starts at RM1,500 income) or Tambadana for quick small loans.

Q: Any processing or hidden fees?

A: Alliance and CIMB generally charge zero processing or early repayment fees. InstaDuit has basic KPKT fees.

Q: What’s the safest option?

A: Always go with licensed lenders or banks. Check for Bank Negara or KPKT registration.

🤐 Takeaway

The best fast personal loan in Malaysia for 2025 depends on what you need:

- RM500–RM10k quickly? Go with Tambadana.

- Bigger loan with better rate? Alliance Bank Digital wins.

- Higher amount, fast decision? CIMB Cash Plus.

- Low-income borrower? Try GX FlexiCredit.

- Simple, non-bank process? instaDuit is worth a look.

Speed is great, but don’t sacrifice affordability. Match the loan to your lifestyle—then pay it off smarter, not harder.

Eczema, Psoriasis, and Allergies in Winter: Understanding Triggers and Treatments

Tip to Benefit Maximally From Your Tow Truck Course

Esports Arena Network Design: 1,000‑Seat LAN & AV Setup (2025 Guide)

Why Jeep Owners Are Switching to Automatic Tops Like eTop

Comparing Demat Account Providers: Which One Should You Choose?

How Anti‑Cheat SDKs Work (Kernel vs User Mode)

NDI vs SRT vs RTMP (2025): Which Stream Protocol Gives You the Lowest Latency for Esports Broadcasts?

New 240Hz 1440p Panels: What Changes for Players

From Chaos to Clarity: How Data Lake Zones Organize the Modern Data Stack