Artificial Intelligence

How can DeepSeek impact US Tech Stocks over the long-term period?

Published

9 months agoon

The recent news from China has rattled the United States tech stocks in what has been a frenzy of selling pressure on virtually every tech stock listed on the NASDAQ.

The race for AI supremacy between the United States and China is a part of a larger story of competition between the two countries, which has taken a new form recently – ChatGPT against DeepSeek.

While the world is still quite far away from achieving an artificial general intelligence (AGI), numerous investors all over the world have bought in heavily into the promise and the developing technology to reach it. The added FOMO on the market further fuels uncertainty on the market, which makes tech stock valuations notoriously volatile and difficult to assess.

US tech stocks leading the AI charge

The United States tech sector is the biggest in the world, by a large margin. Several notable names have been engaged in the development of machine learning algorithms and large language models in recent years, which has been directly tied to a key component of the industry – semiconductors. For this reason, NVIDIA has emerged as one of the biggest stock gainers in recent years, returning over 1,000% in the past two years of trading.

Alongside NVIDIA, the likes of Intel, AMD, Microsoft and Qualcomm have become considerably dependent on the promise and potential of the AI revolution, which has caused these stocks to trade at several multiples above their respective book value.

For this reason, astute investors are cautious about any market updates surrounding artificial intelligence, which creates more volatility and increased number of opportunities for short-term speculators to take advantage of.

OpenAI and the role of private equity

It is worth noting that the AI race is not limited to companies listed on major exchanges, as OpenAI, the company behind ChatGPT, is privately held, which makes matters more complicated for investors, as they have limited opportunities to sell their shares if the company starts to fall behind.

Private investors, such as family offices, venture capitalists and multinational investment banks, have rushed to invest in the early funding rounds of OpenAI, which has reportedly caused the valuation of the company to soar to as much as $157 billion as of October, 2024.

With such a hefty valuation, OpenAI is one of the premier players in the field of artificial intelligence and one of the largest vehicles with which investors can gain exposure to the industry.

However, a major downside of such private investments is that they are notoriously tricky to evaluate, especially during periods of increased market volatility.

What is DeepSeek and why does it matter?

On the other side of the world, Chinese hedge fund High-Flyer launched and financed their own language model, known as DeepSeek, in 2023.

In January 2025, DeepSeek released its first free chatbot, which rivals OpenAI’s GPT-4 by offering advanced AI models at a fraction of the cost and computational resources.

An important feature of the DeepSeek AI is the “mixture of experts” technique, which activates only the absolutely necessary computing resources for a given task and greatly increases efficiency.

Furthermore, DeepSeek claims to use only around 2,000 GPUs to operate, which is considerably lower than the 16,000 needed by most competing AI models. It is also worth noting that DeepSeek uses the H800 series chip from NVIDIA, which means that the global AI industry is nonetheless largely dependent on AI for their microchips, which puts the panicked sell-off caused by the release of DeepSeek into perspective.

How competition from China affects US tech stocks

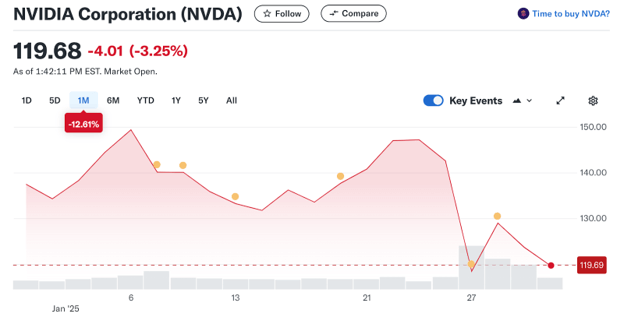

Revisiting the release of DeepSeek chatbots, the United States tech sector saw one of the worst trading days in its history on 27 January, 2025, which saw NVIDIA alone lose over 12% of its market value, while the NASDAQ-100 index fell by over 700 points in a single session.

When assessing the potential impacts of China’s competition with the United States tech sector, there are several important factors that need to be considered:

- A bulk of the near-term AI potential is already priced into the valuations of US semiconductor and AI stocks like NVIDIA, Intel, AMD, Microsoft, Qualcomm, etc.

- Chinese AI models, such as DeepSeek, are still heavily dependent on microchips produced by US and EU manufacturers, such as NVIDIA, ASML, and others

Therefore, the short-term panic on the NASDAQ can be misleading, as the global market for AI is still largely fragmented and none of the players on the market are remotely close to coming up with a functioning artificial general intelligence.

The fact that tech stocks trade at significant earnings multiples also means that every fallback or correction can lead to panic on the market, as many investors are already aware of the fact that the prevailing valuations are largely divorced from the book value of the underlying assets.

Trading during the AI revolution

Sky-high valuations, increased competition and volatility can make it increasingly difficult for retail traders and investors to pick the right points of entry when analyzing the price charts of the likes of NVIDIA, AMD and other major tech stocks.

In some cases, investors choose to wait for significant market panic to buy up shares with lucrative potential at significant discounts, while others assume that the market will continue to grow and they too will be able to take advantage of new value creation.

For those who swear by value investing principles, the market is so profoundly overvalued, that even significant pullbacks are not worth a consideration.

This creates a conundrum between those with significant FOMO and those who assume that the AI “revolution” may one day violently burst – Annihilating trillions of dollars of market value in the process. For those who wish to invest but are sheepish in the face of current tech valuations, the potential of AI may remain as such in the long run.

Conclusion

Artificial intelligence and an increasing competition between the United States and China, has caused a lot of panic and confusion on the US tech market. While investors are optimistic about the future prospects AI holds for humanity, the market side of things leaves a lot to be desired.

High valuations and increased volatility causes investors and traders to be cautious when interacting with stocks that are highly exposed to the AI market. NVIDIA and OpenAI are particularly notable players on the US AI market.

The release of a competing AI chatbot by DeepSeek in January 2025 caused considerable panic and selling pressure on US tech stocks, resulting in double-digit losses for NVIDIA stock.

Going forward, the attitudes of retail investors and traders towards AI stocks might be characterized by even more caution, as the promise of AI has led to levels of volatility on the market that can also deliver considerable losses, alongside sky-high returns.

You may like

Eczema, Psoriasis, and Allergies in Winter: Understanding Triggers and Treatments

Tip to Benefit Maximally From Your Tow Truck Course

Esports Arena Network Design: 1,000‑Seat LAN & AV Setup (2025 Guide)

Why Jeep Owners Are Switching to Automatic Tops Like eTop

Comparing Demat Account Providers: Which One Should You Choose?

How Anti‑Cheat SDKs Work (Kernel vs User Mode)

NDI vs SRT vs RTMP (2025): Which Stream Protocol Gives You the Lowest Latency for Esports Broadcasts?

New 240Hz 1440p Panels: What Changes for Players

From Chaos to Clarity: How Data Lake Zones Organize the Modern Data Stack