FinTech

Best 5 Travel Credit Card for Air Miles in Malaysia 2026

Published

6 days agoon

[Updated on: 23 January 2026] A “travel credit card” in Malaysia isn’t automatically a good travel card just because it says miles, infinite, or world elite. The real value is decided by boring details: how fast you earn, how you convert, what counts as eligible spend, and whether the perks (lounges/insurance) actually match how you travel.

[Updated on: 23 January 2026] A “travel credit card” in Malaysia isn’t automatically a good travel card just because it says miles, infinite, or world elite. The real value is decided by boring details: how fast you earn, how you convert, what counts as eligible spend, and whether the perks (lounges/insurance) actually match how you travel.

If you treat it like a math problem, it gets simpler: you’re trading annual fees + disciplined spending for points that might become a flight, a lounge visit, or travel insurance coverage.

Key Takeaways

- Don’t chase “10x/8x/5x” headlines—translate them into RM spent per mile (or points per RM) first.

- Miles value isn’t fixed. Your “value per mile” depends on what you redeem (and when).

- Lounge access varies wildly: unlimited vs limited passes, principal-only vs shared, and KLIA/KLIA2 terms can change.

- Many cards exclude certain spend types (e.g., some cards explicitly exclude petrol, e-wallets, quasi-cash, fees/charges).

- The best travel credit card in Malaysia depends on your mix of local vs overseas spend, preferred airline program, and whether you pay your balance in full.

Air Miles Travel Credit Card Comparison in 2026

| Rank | Card | Best Earn Scenario | SPM (RM / mile) | ROS | Verdict |

|---|---|---|---|---|---|

| 🥇 | UOB PRVI Miles Elite Credit Card | Agoda / airlines (up to 2.4 mpd) | RM0.42 | 16.7% | Miles monster |

| 🥈 | CIMB Travel World Elite Credit Card | Overseas / airlines / duty-free | RM0.75 | 9.3% | Overseas king |

| 🥉 | Standard Chartered Journey Credit Card | Dining / travel / overseas (5x) | ~RM1.00 | 7.0% | Best all-rounder |

| 4 | HSBC TravelOne Credit Card | Overseas / travel spend | ~RM1.20 | 5.8% | Flexible optimizer |

| 5 | UOB Visa Infinite Credit Card | Overseas spend | ~RM1.25 | 5.6% | Solid premium |

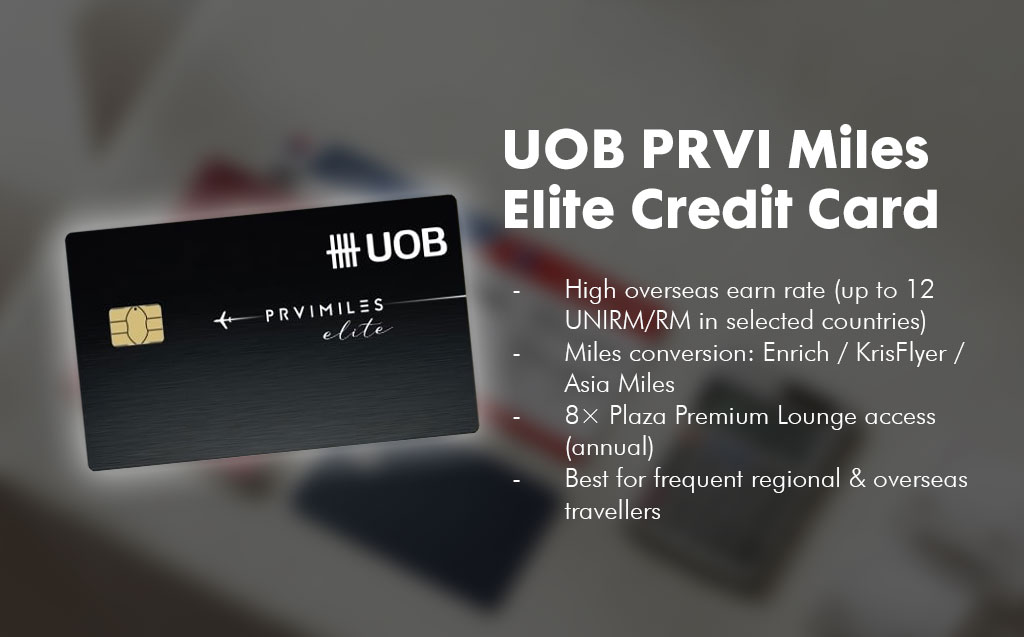

1) UOB PRVI Miles Elite Credit Card

Best for: Frequent travellers who spend overseas (especially in Singapore/Thailand/Vietnam/Indonesia) and want convertible miles + lounge access.

Best for: Frequent travellers who spend overseas (especially in Singapore/Thailand/Vietnam/Indonesia) and want convertible miles + lounge access.

Application difficulty: ⭐⭐⭐☆☆

Min income: RM8,333.33/month, RM100,000/year

Annual fee: RM600 (principal), RM0 (supp); waivers are conditional (see page)

SST: RM25 per principal & supplementary upon activation and anniversary

Earn mechanics (specific):

- Local spend: 1 UNIRM per RM1

- Airline transactions: 5 UNIRM per RM1

- Overseas spend (SG/TH/VN/ID): 12 UNIRM per RM1

- Overseas spend (other countries): 10 UNIRM per RM1

Miles/points currency:

- Earns UNIRinggit (UNIRM)

- Conversion: 12,000 UNIRM = 1,000 miles to Enrich / KrisFlyer / Asia Miles

Travel perks (only what’s stated):

- 8x complimentary access per calendar year to selected Plaza Premium Lounge locations (includes Private Lounge at KLIA1)

- Note on lounge changes (as stated on page) + supplementary lounge eligibility change

- Personal accident coverage up to RM300,000 (includes items listed on the page)

Pros

- Strong earn rate for selected ASEAN overseas spend (12 UNIRM/RM1).

- Miles’ conversion to Enrich/KrisFlyer/Asia Miles is explicitly shown.

- Lounge access allocation is clearly stated (8x/year).

Cons

- High annual fee unless you meet waiver conditions.

- Lounge access terms include change notes and supplementary restrictions (as stated).

Verdict: A miles-focused card that shines when your overseas spend matches its higher-earning countries and you value lounge access.

2) CIMB Travel World Elite Credit Card

Best for: High spenders who want premium lounge access and strong points earning on overseas/airlines/duty-free spend.

Best for: High spenders who want premium lounge access and strong points earning on overseas/airlines/duty-free spend.

Application difficulty: ⭐⭐⭐⭐⭐

Min income: RM20,833.33/month, RM250,000/year

Annual fee: RM1,215.09 (principal), RM0 (supp); waiver tiers based on annual spend SST: RM25 per principal & supplementary upon activation and anniversary

Earn mechanics (specific):

- Overseas + airlines + duty-free: 10x Bonus Points per RM1

- Other local spending: 2x Bonus Points per RM1

- Local education/insurance/utilities: 1x Bonus Point per RM1

Miles/points currency:

- Earns CIMB Bonus Points

- “Pay With Points” is stated as 500 Bonus Points = RM1 (participating merchants).

- Conversion ratios/airline partners are not stated on the page—verify issuer.

Travel perks (only what’s stated):

- 12x shared complimentary access annually to Plaza Premium First (KLIA) + participating Plaza Premium lounges worldwide (shared principal + supplementary).

- 12x access to Sky Lounge at SkyPark Terminal, Subang (valid till 31 Jan 2026 as stated).

- Travel medical + accident insurance up to USD 500,000 if you charge full travel fares (activation specifics not fully detailed on the summary).

Pros

- Very clear earning emphasis on overseas/airlines/duty-free (10x).

- Premium lounge access volume is explicitly stated (Plaza Premium First + global lounges).

- “Pay With Points” conversion (500 points = RM1) is stated, which helps estimate floor value.

Cons

- High income requirement + high annual fee unless you meet waiver spend thresholds.

- Airline-mile transfer partners/ratios aren’t specified on the summary—extra homework required.

Gotchas / fine print to watch

- Insurance requires charging “full travel fares” (details are summary-level—verify PDS).

- FX fees and points expiry are not stated here—verify issuer terms.

Verdict: A premium travel card where the lounge benefits and 10x overseas-style earn can make sense—if you’re already in the required income/spend bracket.

3) Standard Chartered Journey Credit Card

Best for: Travellers who want unlimited KLIA/KLIA2 lounge access (principal) and spend heavily on dining/travel/overseas retail.

Best for: Travellers who want unlimited KLIA/KLIA2 lounge access (principal) and spend heavily on dining/travel/overseas retail.

Application difficulty: ⭐⭐⭐☆☆

Min income: RM8,000/month, RM96,000/year

Annual fee: RM600 (principal), RM0 (supp); waiver conditions shown on page

SST: RM25 per principal & supplementary upon activation and anniversary

Earn mechanics (specific):

- Dining, travel, overseas retail: 1 Miles Point per RM1

- Eligible local spends: 1 Miles Point per RM5

- Stated exclusions (summary-level) include: government-related transactions, cash withdrawals, utilities (telco/cable TV), e-wallets, and certain “special events” categories.

Miles/points currency:

- Earns Miles Points

- Conversion: 2 Miles Points = 1 Air Mile

- Airline partners/transfer details: Not stated—verify issuer T&Cs.

Travel perks (only what’s stated):

- Unlimited access to participating Plaza Premium Lounge in KLIA and KLIA2 for principal with a valid international boarding pass.

- Airport transfer promo: “save up to RM65 via Grab ride to/from any airport in Malaysia” with stated spend condition.

Pros

- Unlimited KLIA + KLIA2 Plaza Premium Lounge access (principal) is a standout perk.

- Straightforward 1 point per RM1 for dining/travel/overseas retail.

Cons

- Local “other spend” earns slowly (1 point per RM5).

- Multiple exclusions are explicitly noted (e-wallets, certain utilities, etc.).

Gotchas / fine print to watch

- Your “local spend” must be eligible; excluded categories can quietly reduce earn.

- Airline partners/transfer mechanics aren’t listed in the summary—verify issuer before valuing points.

Verdict: A strong lounge-first card if you can use unlimited KLIA/KLIA2 access, but it’s less attractive for general local spending.

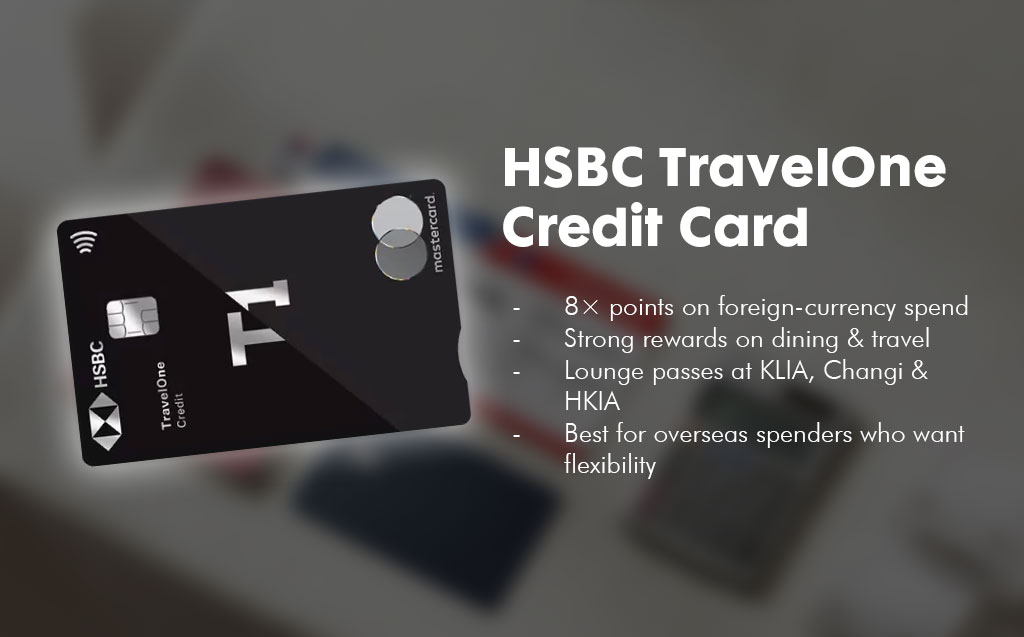

4) HSBC TravelOne Credit Card

Best for: Travellers with meaningful foreign-currency spend who also want points on local dining + travel and a small set of regional lounge passes.

Best for: Travellers with meaningful foreign-currency spend who also want points on local dining + travel and a small set of regional lounge passes.

Application difficulty: ⭐⭐⭐⭐☆

Min income: RM8,500/month, RM102,000/year

Annual fee: RM300 (principal) (first year free; waiver condition stated), RM150 (supp)

SST: RM25 per principal & supplementary upon activation and anniversary

Earn mechanics (specific):

- Foreign currency spend: 8x Reward Points

- Local travel (hotels/airlines/travel agencies): 5x Reward Points

- Local dining: 5x Reward Points

- Other eligible spend: 1x Reward Point

- Stated exclusions include petrol, government-related, charitable, Quasi Cash, and fees/charges.

Miles/points currency:

- Earns HSBC Reward Points

- Summary lists redemption options/partners (e.g., air miles/hotel points), but conversion ratios aren’t stated—verify issuer.

Travel perks (only what’s stated):

- 6x complimentary annual lounge passes (shared principal + supplementary) to participating Plaza Premium Lounge in KLIA, Singapore Changi, Hong Kong International Airport.

- Travel insurance up to USD 250,000 if you charge the full fare of flight tickets with the card.

Pros

- Clear “foreign currency spend” multiplier (8x) for overseas-heavy users.

- Lounge passes include KLIA + major regional hubs (Changi, HKIA).

- Insurance trigger is clearly stated (full fare flight tickets charged to card).

Cons

- Conversion ratios/partners are summary-level; hard to value points without checking issuer details.

- Exclusions include petrol and other categories (as stated).

Gotchas / fine print to watch

- Miles value depends on conversion ratio and partners (not provided here)—verify before assuming “miles value.”

- If your “travel” spend doesn’t code as a travel agency/airline/hotel, your earn rate may differ—verify MCC rules in T&Cs. (Not stated in summary.)

Verdict: A practical pick for foreign-currency spenders, but you’ll need issuer confirmation on conversion ratios to judge true miles value.

5) UOB Visa Infinite Credit Card

Best for: High-income travellers with regular overseas FX spend, who also value DragonPass lounge access and limo perks, and can hit the dining threshold for bonus points.

Best for: High-income travellers with regular overseas FX spend, who also value DragonPass lounge access and limo perks, and can hit the dining threshold for bonus points.

Application difficulty: ⭐⭐⭐⭐☆

Min income: RM10,000/month, RM120,000/year

Annual fee: RM600 (principal), RM300 (supp); waivers are conditional (see page)

SST: RM25 per principal & supplementary upon activation and anniversary

Earn mechanics (specific):

- Overseas spend (foreign currency): 10 UNIRinggit points per RM1

- Dining:

- 5 points per RM1 if monthly total dining ≥ RM1,000

- otherwise 1 point per RM1 on dining

- Other local spends: 1 point per RM1 (with stated exclusions such as cash advance, IPP, petrol, certain bodies/organisations)

Miles/points currency:

- Earns UNIRinggit

- Conversion: 12,000 UNIRinggit = 1,000 miles to Enrich / KrisFlyer / Asia Miles

Travel perks (only what’s stated):

- Lounge: 12x complimentary access to selected airport lounges in Asia Pacific via Airport Companion by DragonPass mobile app (includes private lounge at KLIA1; 1 access per day).

- Note on KLIA Terminal 2 lounge availability change (as stated).

- Travel insurance up to RM500,000 when you charge air ticket bills to the card (benefit breakdown shown on page).

- Limo: “up to 12x complimentary limo services to KLIA/KLIA2” with stated spend condition.

Pros

- Clear overseas earning (10 points/RM1 in foreign currency).

- Convertible miles pathway (Enrich/KrisFlyer/Asia Miles) is explicitly listed.

- Lounge + insurance perks are clearly described at summary level.

Cons

- Dining bonus depends on hitting RM1,000 monthly dining—miss it and you drop to 1 point/RM.

- Lounge access includes a note about KLIA T2 availability changes (as stated).

Gotchas / fine print to watch

- FX fee and points expiry are not stated on this summary—verify issuer T&Cs/PDS.

- Exclusions apply to “other local spends” earning—verify the latest exclusion list before modelling your returns.

Verdict: A premium option that can rack up miles quickly on overseas spend, but the real-world value hinges on whether you consistently hit the dining and perk-qualification thresholds.

Why Do You Need Travel Credit Card

Earn Points and Miles

Travel cards reward you in one of two buckets:

- Air miles (or miles-like points) you can convert into airline miles

- Bank reward points that may be redeemable for cash/merchants, or convertible to airlines/hotels (depending on the issuer)

The key difference: miles are usually more valuable for flights, but bank points can be more flexible (and sometimes easier to use).

Spending That Convert to Points

Most travel cards reward “retail spend,” but the definition of “eligible spend” can be strict.

From the card summaries you’re using, some examples of exclusions are explicitly stated:

- Some programs exclude categories like petrol, government-related transactions, charity, quasi-cash, and fees/charges from points earning.

- Some cards list e-wallets or certain utilities as excluded for earning.

Practical takeaway: before you assume your monthly spend earns miles, verify the issuer’s excluded transaction list, especially if you spend heavily on:

- e-wallet reloads/top-ups

- government services

- utilities/telco

- insurance payments

- instalments / payment plans

- cash-like transactions (gift cards, money transfers, etc.)

Redemption Flexibility (airline miles vs bank points)

Think of redemption flexibility as a spectrum:

- Airline miles (e.g., Enrich/KrisFlyer/Asia Miles)

- Pros: potentially strong value for flight redemptions

- Cons: availability varies; programs can change redemption rates; miles may expire

- Bank points (issuer currency)

- Pros: sometimes redeemable as statement credit/merchant redemption; can be less stressful than chasing award seats

- Cons: conversion partners/ratios may not be clear upfront; banks can change conversion rates or partners

If a card doesn’t clearly show airline conversion partners/ratios, treat the miles value as uncertain until you confirm it.

Travel Insurance Activation

Travel insurance bundled with a credit card is only useful if you can trigger it correctly.From your data sources, examples of activation wording include:

- Insurance coverage applies if you charge the full travel fare (or full flight ticket) to the card.

- Some cards specify coverage amounts (e.g., travel medical/accident limits) but don’t fully detail exclusions in the summary.

Practical checklist before you depend on card insurance:

- Does it require full fare or any partial payment?

- Does it cover family/supplementary cardholders?

- Does it include medical vs only accidents?

- What counts as “travel fare” (flight only vs hotels vs agencies)?

- What documentation is required for claims?

Airport Lounge Access

Lounge access is one of the most overvalued perks—until you actually travel often. When it matters, it’s great. When it doesn’t, you’re paying annual fees for a perk you rarely use.

What to look for:

- Unlimited vs limited passes (e.g., “unlimited lounge access at KLIA/KLIA2” vs “6 or 12 passes per year”)

- Principal-only vs supplementary access

- Is it shared between principal and supplementary?

- Where it works: KLIA, KLIA2, overseas hubs

- Changes/withdrawals: lounge access at specific terminals can be discontinued

For a deeper breakdown of which cards get you into which lounges (and the fine print around guesting, terminals, and yearly quotas), see our guide for Credit Card with Free Lounge Access

3 Key Formula for Travel Credit Card

Below are three formulas you can use to judge any miles credit card in Malaysia without getting lost in marketing.

Spending per Mile (SPM)

Explain

“Earn rate” is only meaningful after you translate it into a single question:

How many RM do I need to spend to earn 1 mile?

If a card earns points and then converts to miles, you need:

- points earned per RM, and

- points-to-miles conversion ratio

Example (using cards that explicitly show conversion ratios in your data)

- If a card earns 1 point per RM1, and 12,000 points = 1,000 miles, then:

- 12,000 points = 1,000 miles → 12 points = 1 mile

- 1 point/RM → 1/12 mile per RM

- Spend per mile = RM12 per mile

If the same card earns 10 points per RM1 on overseas spend:

- 10 points/RM → 10/12 = 0.833 miles/RM

- Spend per mile = RM1.20 per mile

Takeaway

Before you compare cards, convert everything into either:

- miles per RM, or

- RM per mile

It instantly exposes whether a card is only good for overseas spend, travel categories, or specific merchants.

Value per Mile (VPM)

Explain

Miles have no fixed cash value. The value depends on what you redeem. The clean way to estimate is:

Value per mile = (cash price you would have paid – taxes/fees you still pay) ÷ miles used

Example (hypothetical numbers to show the method)

- If a flight costs RM900 in cash

- You redeem it for 30,000 miles and still pay RM120 in taxes/fees

- Value per mile = (900 – 120) ÷ 30,000

- = 780 ÷ 30,000

- = RM0.026 per mile (about 2.6 sen/mile)

Takeaway

Don’t argue about “the best value per mile” online. Calculate your value based on redemptions you’d realistically take (economy vs business, regional vs long-haul, peak dates vs off-peak).

Return on Spending (ROS)

Explain

Once you know:

- how fast you earn (miles per RM), and

- your value per mile (RM per mile),

- you can estimate an effective return:

Return % ≈ (miles per RM × RM value per mile) × 100

Example

Using earlier examples:

- If your earn rate is 0.5 mile per RM (e.g., after conversion), and

- you consistently redeem at 2.0 sen per mile (RM0.02),

- Return % ≈ 0.5 × 0.02 × 100 = 1%

If your overseas earn rate is 0.833 mile per RM and your redemption value is 2.6 sen per mile:

- Return % ≈ 0.833 × 0.026 × 100 ≈ 2.17%

Takeaway

Miles cards only “win” when:

- you redeem well, and

- you avoid interest/late charges, and

- your spending actually earns at the rate you think it does (category rules matter)

Enrich vs KrisFlyer vs Asia Miles

You don’t need to be loyal to an airline forever. But you do need a default direction, because splitting points across too many programs often means you never earn enough in any one place.

Enrich (Malaysia Airlines + partners; who it fits)

Enrich is the natural starting point for Malaysians who:

- fly Malaysia Airlines often, or

- want a home-base program that’s locally familiar

Good fit if you:

- mainly travel within the region

- prefer a program you’ll actually use rather than “maximising theoretical value”

Watch-outs:

- always check miles validity/expiry rules and redemption rates at the time you plan to redeem (programs can change)

KrisFlyer (Star Alliance; premium cabin angle)

KrisFlyer is typically chosen by travellers who:

- want broader international reach through alliance networks, or

- aim for premium cabin redemptions over time

Good fit if you:

- take longer-haul trips

- can plan and redeem strategically

Watch-outs:

- premium cabin redemptions depend heavily on seat availability and timing

- fees/surcharges and redemption rates can change

Asia Miles (Cathay/oneworld; who it fits)

Asia Miles often appeals to travellers who:

- fly via regional hubs, or

- want access to oneworld-style networks and partner options

Good fit if you:

- travel frequently in Asia and beyond

- can be flexible with routes and dates

Watch-outs:

- redemption sweet spots can shift; don’t over-earn in a program you rarely use

Practical guidance (Malaysia context):

- If your travel is mostly a few KL → ASEAN trips a year, pick the program you’re most likely to redeem without stress.

- If you’re chasing higher value redemptions, accept that it’s a hobby: planning and flexibility become part of the “cost.”

More Flexible Options: Bank Points (transferable currencies)

Some travel cards don’t give you “miles” directly. They give you bank points first. The advantage is flexibility—if you can convert them to the programs you want at a fair ratio.

Based on your data sources, here are the point currencies that appear:

- UOB UNIRinggit / UNIRM: explicitly shown as convertible to Enrich/KrisFlyer/Asia Miles at 12,000 points = 1,000 miles (for the UOB cards in your set).

- CIMB Bonus Points: earns strongly on overseas/airlines/duty-free in your dataset; also shows a “Pay With Points” merchant redemption reference (500 points = RM1) in the summary.

- HSBC Reward Points: strong multipliers on foreign currency and local dining/travel in your dataset; conversion ratios aren’t stated in the summary, so treat transfer value as “verify first.”

- Standard Chartered Miles Points: shown as convertible at 2 points = 1 air mile in your dataset; airline partners aren’t listed in the summary.

Why flexible points can be safer

- You can delay deciding which airline program to commit to

- You may redeem via merchants/statement options if travel plans change (where offered)

Why flexible points can disappoint

- Conversion partners/ratios may not be transparent in summaries

- Banks can change transfer ratios or partner lists

- Points may have expiry rules that differ from airline miles (not always clearly stated upfront)

Rule of thumb:

If a card doesn’t clearly state (1) conversion ratio and (2) where you can convert, don’t assign it a “miles value” until you verify those details from the issuer.

Conclusion

A travel credit card in Malaysia is worth it when it matches your real travel life:

- You spend enough in the categories that earn well (often overseas FX, travel, dining)

- You’ll actually use the perks (lounges, insurance)

- You redeem consistently (even once a year is fine)

- You pay your statement in full so interest doesn’t wipe out the value

Choose in 3 steps

- Pick your redemption direction: Enrich, KrisFlyer, Asia Miles, or “flexible points first.”

- Map your spend: local vs overseas, dining/travel categories, and any thresholds (monthly dining minimums, travel spend requirements).

Validate the perks: lounge access limits (and terminal coverage), insurance activation trigger, annual fee waiver conditions, and exclusions.

FAQ

What is the best travel credit card Malaysia 2026?

There isn’t one best card for everyone. The best travel credit card is the one whose earn rates match your biggest spend categories and whose miles or points can be redeemed in a program you’ll actually use.

Is a miles credit card Malaysia worth it if I only travel 1–2 times a year?

It can be, if the card earns well on normal spending such as dining or overseas purchases and you redeem consistently. If you rarely redeem, a cashback credit card may be simpler and more predictable.

How do I know my spending per mile?

Use this formula: RM per mile = 1 ÷ (miles per RM). If a card earns points that convert to miles, first calculate miles per RM using the earn rate and the conversion ratio.

Do e-wallet top-ups count for miles?

It depends on the issuer’s rules. Some programs explicitly exclude e-wallet related transactions from earning miles. Always check the excluded transaction list in the issuer’s terms and conditions.

Does petrol spending earn miles on travel cards?

It depends on the card. Some summaries explicitly list petrol spending as excluded from points earning. Verify the earn exclusions before assuming petrol contributes to miles.

How does airport lounge access usually work?

Common patterns include unlimited access (often principal cardholder only), a fixed number of passes per year, or passes shared between principal and supplementary cardholders. Always check where it applies, such as KLIA, KLIA2, or overseas lounges.

Can lounge benefits change?

Yes. Some card summaries note that lounge access at specific terminals may be discontinued. Treat lounge access as a useful extra, not a permanent guarantee.

How do I activate travel insurance on a credit card?

Many cards require you to charge the full travel fare, often flight tickets, to the card. Always confirm what qualifies, who is covered, and what documents are needed for claims.

Should I collect Enrich, KrisFlyer, or Asia Miles?

Choose based on where you fly most and what you redeem. If you want simplicity and local familiarity, Enrich may suit you. If you want broader international routes and are willing to plan, KrisFlyer or Asia Miles may be a better fit.

What should I verify before applying for any travel credit card?

Check the minimum income requirement, annual fee and waiver conditions, conversion ratio and partners, points or miles expiry, foreign exchange fees, lounge access terms, and excluded spending categories.

You may like

Car Insurance Policy Basics: Key Terms Every Car Owner Should Understand

What Is Travel Insurance and How Does It Work When You’re Abroad?

What is Balance Transfer for Credit Card in Malaysia (2026)

Pivots to Your Technical Business That Just Make Sense Heading Into 2026

When to Use Antihistamine Eye Drops: A Guide to Allergy Eye Relief

Best 5 Travel Credit Card for Air Miles in Malaysia 2026

Best 5 Petrol Credit Card Malaysia 2026: Cashback Guide

Best Cashback Credit Card in Malaysia 2026: Petrol, Groceries, Utilities

PayNow vs DuitNow for Tourists: How to Pay in Singapore and Malaysia