FinTech

Direct Lending vs. Personal Loan: What’s the Difference in Malaysia?

Published

5 months agoon

By

Samuel TingTable of Contents

Let’s be honest—when you’re short on cash and the bills are knocking, figuring out which loan to take isn’t always straightforward. You’ve probably heard about direct Lending and personal loans, or maybe you’ve checked our article covering the basics about personal loans in Malaysia but still don’t know what’s the actual difference?

I’ve dealt with both. One was fast, the other more flexible. And depending on your needs (speed, amount, repayment style), one might be better than the other. Let’s break it down in plain language—with real facts, simple comparisons, and a few insights I’ve picked up along the way.

What is Direct Lending—and Why Is It Suddenly Everywhere?

Direct Lending in Malaysia is a service that connects borrowers (like you and me) directly to licensed financial institutions, cooperatives, or moneylenders—without going through a bank.

Think of it as a shortcut. You get access to the best fast loans in Malaysia with minimal paperwork, and if you’re a government servant or GLC staff, things move even quicker—because repayments are made through salary deductions.

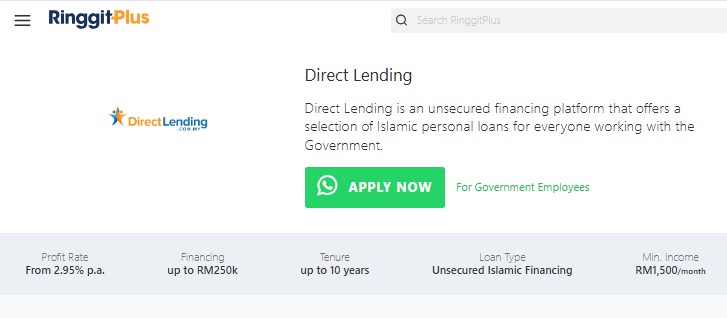

According toRinggit Plus, direct Lending instant loan in Malaysia, by submitting the documents required including payslip and IC copy, and boom—fund will be landed in account in 24 hours. No long queues, no awkward calls from bank officers.

What About Traditional Personal Loans?

Personal loans from banks are more familiar—stable, structured, and often cheaper over the long run. You borrow a fixed amount, pay it back in equal instalments over a few years, and the interest is agreed upfront.

They’re great if you’re planning something big—like home renovations or debt consolidation—and don’t mind waiting a few days for approval.

But you’ll need to jump through a few more hoops: submit income docs, prove your creditworthiness, and sometimes, wait nervously while the bank “considers” your application.

Which Loan Works Better?

| Feature | Direct Lending | Bank Personal Loan |

| Approval Speed | Within hours (sometimes minutes) | 1–3 working days |

| Loan Amount | Typically RM5k–RM150k | RM5k–RM200k or more |

| Interest / Profit Rate | From 2.95% p.a. (salary deduction) | From 3.99% flat rate |

| Best For | Civil servants, emergencies | Larger expenses, stable repayment |

| Repayment Method | Salary deduction | Auto-debit or manual payment |

| Shariah-Compliant Option | Yes | Yes (depends on the bank) |

| Hidden Fees | Usually none | Most banks have removed processing fees |

For when Direct Lending will be the Smarter Choice?

Here’s when Direct Lending really shines:

- You need the cash now, not next week.

- You’re a government employee or GLC staff.

- You want zero fuss—no meetings, no office visits.

- Your credit score isn’t great, but your salary is steady.

- You prefer Islamic, Shariah-compliant financing (many options are).

Plus, the profit rates are surprisingly low. In some cases, lower than bank loans—because the risk is lower with salary deduction.

One of my colleagues took a RM30k Direct Lending loan and got it approved within the day. The entire process was online, no fees, and he said the instalments were auto debit without him needing to think twice every month. That kind of ease matters when you’ve got a full plate.

For when a Bank Loan will Make More Sense?

Still, bank loans aren’t outdated. They’re just built for different situations:

- You need a larger amount (above RM50k).

- You want the option to settle early without penalties.

- You’re comfortable waiting a few days for approval.

- You don’t want a loan tied to your salary account.

- You’re aiming for a longer tenure (some banks go up to 10 years).

Taking UOB personal loan as example—got a flat rate of 3.99% and a 5-year term. Paid slightly more per month, but the total interest was lower, and you will have breathing room if you wanted to pay early.

Real Talk: Direct Lending vs. Bank Loan Experience

| Loan Provider | Amount | Tenure | Monthly | Total Interest | Approval Time |

| Direct Lending | RM10k | 3 yrs | RM300 | ~RM800 | 24 hours |

| UOB Bank Loan | RM50k | 5 yrs | RM976 | ~RM8,600 | 3 working days |

Here’s the takeaway: for short-term needs, Direct Lending is quicker and less stressful. But for larger sums or longer terms, banks still offer the best bang for your buck—if you’re willing to wait a bit.

5 Things They Don’t Tell You About Fast Loans

1. “Low interest” isn’t always cheaper.

That 3.99% flat rate at the bank? The effective interest rate (EIR) could be 7–9%. Always ask for EIR or use a loan calculator to see the real cost.

2. Cashback is real money.

Some loans, like Alliance Bank CashFirst, offer cashback on interest paid—effectively reducing your cost. This isn’t gimmicky. It’s tax-free savings.

3. Your salary deduction loan appears on CCRIS.

Yes, even though it’s from a cooperative or licensed lender, it’s reported. So don’t max out if you plan to apply for a mortgage soon.

4. Islamic financing ≠ more expensive.

Actually, many Islamic instant loans (like from Bank Islam or HSBC Amanah) offer competitive rates—and fewer fees.

5. Repaying early is sometimes a trap.

Some lenders don’t waive the interest for early settlement—so ask before signing. Banks are usually better on this front.

Step-by-Step: How to Apply for a Direct Lending Loan

- Go to a verified platform

- Choose a product suited to your job status (gov/private sector).

- Upload your IC, payslip, and consent for salary deduction (if required).

- Wait for approval (sometimes less than 2 hours).

- Receive your funds via bank transfer. Done.

You can even complete the entire process from your phone during lunch break.

Takeaway: Which One Should You Choose?

The best loan isn’t the one with the flashiest headline. It’s the one that fits your life.

✅ Need money now, work in public service, and want everything online? Direct Lending is your best friend.

✅ Have time to wait, want the lowest possible rate, or need more than RM50k? A traditional bank personal loan might suit you better.

Either way, know this: borrowing isn’t a weakness—it’s a tool. Used right, it can get you out of a jam or closer to your goals. Just borrow with a clear plan—and stick to it.

FAQs

Q: Is Direct Lending legal and safe?

Yes—if you go through a licensed platform under KPKT (Ministry of Housing and Local Government). Always check the lender list.

Q: Can I apply if I work in the private sector?

It depends. Some lenders on the platform cater to private workers, but most benefits (like lower rates and salary deduction) are geared towards civil servants.

Q: Is the approval really that fast?

In many cases—yes. Just be sure your documents are clear and recent.

Q: Will this affect my ability to borrow from banks later?

Yes—every loan shows up on your credit report. But it won’t hurt you if you pay on time.

Eczema, Psoriasis, and Allergies in Winter: Understanding Triggers and Treatments

Tip to Benefit Maximally From Your Tow Truck Course

Esports Arena Network Design: 1,000‑Seat LAN & AV Setup (2025 Guide)

Why Jeep Owners Are Switching to Automatic Tops Like eTop

Comparing Demat Account Providers: Which One Should You Choose?

How Anti‑Cheat SDKs Work (Kernel vs User Mode)

NDI vs SRT vs RTMP (2025): Which Stream Protocol Gives You the Lowest Latency for Esports Broadcasts?

New 240Hz 1440p Panels: What Changes for Players

From Chaos to Clarity: How Data Lake Zones Organize the Modern Data Stack