FinTech

Best Fixed Deposit (FD) Rate Malaysia [July 2025]

Published

4 months agoon

By

Samuel TingWhen it comes to low-risk, stable savings options in Malaysia, fixed deposits (FDs) continue to stand strong — even in 2025. Whether you’re saving up for a future goal or just looking for a place to safely park your money, FDs offer guaranteed returns, flexible tenure options, and protection under PIDM (up to RM250,000 per depositor per bank).

The usual rate of FD in Malaysia ranges from 2%-4%, depending on the bank, deposit tenure and deposit amount. Once in a while, banks would introduce FD at better rates for different campaigns.

Recent news suggests that the banking sector may face margin pressure, potentially leading to an OPR cut. This development is largely influenced by the ongoing U.S. tariff war, which has been drawing significant global attention.

What Exactly is a Fixed Deposit?

In simple terms, an FD (Fixed Deposit) is a savings product where you lock in a lump sum of money for a set period, and in return, the bank pays you a fixed interest rate. The longer your tenure and the larger your deposit, the higher the returns — and the rate is locked in, no matter how the market changes.

Why Choose Fixed Deposit?

Despite many external voices that say fixed deposits are bad investments due to their low interest, it is indeed, the best option for those who do not know about investment. The features of a fixed deposit: low risk, predictable return, simple structure are ideal for conservative savers, retirees or anyone who wants to earn stable passive income. You do not need to worry about market fluctuations, economy status or any other factors that might usually affect other types of investments.

In this guide, we’ve compared the best FD rates in Malaysia for 2025, so you can easily find the highest fixed deposit interest rate in Malaysia that matches your savings goal and risk tolerance. Whether you prefer a short-term 3-month FD or a long-term 12-month plan, this Malaysian bank FD comparison will help you make a smarter financial choice.

Comparison of Malaysia Bank FD Rate under 12 Months Tenure (July 2025)

| No. | Bank | FD Rate | Min. Deposit | Early WIthdrawal |

| 1 | Alliance Bank | 2.70% | RM500 | ✅ |

| 2 | UOB | 2.70% | RM500 | ❌ |

| 3 | Standard Chartered | 2.70% | RM1,000 | ❌ |

| 4 | BSN | 2.70% | RM500 | ❌ |

| 5 | OCBC | 2.55% | RM1,000 | ✅ |

| 6 | HSBC | 2.55% | RM1,000 | ✅ |

| 7 | Public Bank | 2.50% | RM1,000 | ❌ |

| 8 | Hong Leong Bank | 2.50% | RM10,000 | ✅ |

| 9 | RHB | 2.50% | RM500 | ✅ |

| 10 | CIMB | 2.50% | RM1,000 | ✅ |

| 11 | Ambank | 2.50% | RM500 | ❌ |

| 12 | Maybank | 2.45% | RM1,000 | ❌ |

| 13 | Hong Leong Bank | 2.35% | RM500 | ✅ |

| 14 | Affin Bank | 2.35% | RM500 | ✅ |

Note: Above FD Malaysia are protected under PIDM.

Pros and Cons of Fixed Deposits

When it comes to growing our savings with minimal risk, fixed deposits (FDs) often sit at the top of our list. They’re dependable, straightforward, and a great way to build financial discipline. But like any financial product, they come with their own set of trade-offs. Let’s break down the pros and cons from our point of view so we can make smarter decisions together.

Pros of Fixed Deposits

1. Guaranteed Returns

We appreciate knowing what is certain and that’s exactly what fixed deposits can offer. As soon as we set our funds at a fixed rate, we can predict the final amount we’ll receive. Our returns from FD are safe even if the market changes. In this way, if we put RM10,000 in a 12-month FD paying 3.80% per year, we will earn RM380 by the end of the term. It feels good to have your finances backed up by numbers.

2. Capital Protection

We know for sure that our principal is not in danger. As soon as we keep our money with licensed banks in Malaysia, the first RM250,000 is insured by PIDM (Perbadanan Insurans Deposit Malaysia). This means we are covered by safety, not only wishing for it.

3. Low Risk, Low Stress

Not all people are willing to face the ups and downs of stocks or crypto. For those who want security instead of taking risks, fixed deposits are the choice. In case you have short- to mid-term goals like saving for a car, going on a trip or starting an emergency fund, FDs are a safe option in your portfolio.

4. Flexible Tenure Options

Choices make us feel better. No matter if we are on a 1-month or 36-month FD, we can make it fit our financial goals. Sometimes, banks run promotions for loan tenures that are not common such as 7 or 13 months.

Cons of Fixed Deposits

- Limited Liquidity

If we take our money out early, we often will lose some or all of the interest we earned. Therefore, if we doubt we can keep our money safe for years, it’s best to look elsewhere with our cash. Let’s say we pull out an FD after just 3 months; we could get zero interest. - Lower Returns Compared to Other Investments

Although you can rely on FDs, they will usually give lower returns than unit trusts, ETFs or real estate. If we are aiming for big gains or to beat inflation in the future, FDs might not get the job done fast enough. - Inflation Risk

Fixed deposits pay a fixed income, but inflation is always possible. Since our FD gives 3.80% and inflation is 4%, we effectively lose money. As our money increases, the things it can buy may actually become less. - Taxable Interest

In the past, interest earned on FDs was free from taxes, but now it is considered taxable when those accounts are set up under trusts or non-individual accounts. FDs placed by Malaysians for their own use are often tax-exempt, unless we place our funds in a certain way.

Types of FDs Available in Malaysia

There is a large selection of fixed deposits available in Malaysia and this is something good for us. Everyone can select FDs based on their goals, the way they live and how flexible they are. Seeing what’s out there helps us pick the right approach for our finances. The following are the main kinds of FDs that we can use:

1. Conventional Fixed Deposits

You’ll find that the classic term FD works the same for most of us. To invest, we make a large deposit, decide the time period (usually between 1 month and 60 months) and get a fixed rate of interest. When we stay with the same company for longer periods, the rate usually increases and it can increase more during promotions. It works well when we have the chance to put some money aside before we spend it.

RM20,000 put into a 12-month FD at 3.85% p.a. will give you RM770 in guaranteed earnings.

2. Islamic Fixed Deposits (Commodity Murabahah)

When it comes to Shariah-approved FDs, the concept of profit-sharing is used rather than interest. The most popular structure is Commodity Murabahah which involves buying and selling goods to create profit rather than charging interest. What happens as a result? The earnings are decided at the start and function in the same way as a regular FD with the approval of Islamic law.

3. Foreign Currency Fixed Deposits

Do we plan to explore other countries, put money in assets abroad or simply mix up what we own? We can put money in USD, GBP, AUD or SGD when we have foreign currency FDs. You can sometimes get a better deal with them, especially when the exchange rate is in your favor, but there is more risk because of currency changes.

For example, if we turn RM50,000 into USD and invest it for six months in a USD FD at 4.50%, we can earn more than what local rates provide, but we could still lose money if the ringgit appreciates a lot.

4. Flexi or Partial Withdrawal Fixed Deposits

We understand that, at times, you’d like to use your money before the FD ends. In this case, flexi FDs can be a good option. Some banks have FDs that make it possible to withdraw part of your money without reducing the interest on the rest. It means we have a backup plan and our profits are not lost.

For instance, we use RM30,000 to invest in a flexi FD. When an emergency arises and we need RM5,000, we may withdraw it and the rest will continue to earn interest.

5. Auto-Renewal Fixed Deposits

This product is made for those who like to set it once and leave it alone. At maturity, the balances in auto-renewal FDs are rolled over using the highest rate set by the board. This process keeps our money working for us, yet we should make sure the new rate is still attractive.

Some banks provide higher rates when we renew our loan, so it could be better to allow auto-renewal over the years.

6. Promotional or Campaign FDs

Every so often, banks organize FD campaigns with special, higher interest rates that may need a new deposit or be linked to other products. They are best suited for when we move a big sum or switch our bank. The trick? We pay close attention and compare banks because a slight difference in interest rates can bring us a lot more money.

So, a special offer of 4.10% per year for 6 months on RM100,000 gains us RM200 extra over the standard rate of 3.70% for the same period.

Difference Between Savings and Fixed Deposit Accounts

Common advice we get is to deposit our money in a savings account or to fix it in a deposit account. However, what’s actually the distinction between the two and when is one better to use than the other?

Let’s consider it from our point of view to figure out the best choices for our lives and aims.

-

Purpose & Usage

Savings Account:

We use this bank almost every day for our transactions. Our savings account can be used to remove cash, pay bills, send money and receive our pay which we do often. It’s designed to include money that we will use for our daily or quick needs.

Fixed Deposit (FD):

FDs, on the other hand, are meant for money we don’t plan to touch for a while. We lock in a lump sum for a set period — usually from 1 month up to 5 years — in exchange for higher interest. This is our “park and grow” option, not something we dip into for groceries or bills.

-

Interest Rates

Savings Account:

Typically, interest rates are not high, ranging from 0.25% to 1.50% every year. The upside? Interest is added to our account each day and paid out monthly or quarterly and we are free to withdraw our money anytime.

Fixed Deposit:

FDs are at their best in this situation. In some promotions, we are able to earn interest rates of over 3.50% to 4.00% a year. However, we cannot withdraw any money during the tenure if we want to enjoy the highest return.

-

Liquidity (Access to Money)

Savings Account:

Completely flexible. If we choose to withdraw, we can do so anytime and there are no penalties or questions needed.

Fixed Deposit:

Not as easy to convert into cash. If we take out the money before the agreed time, we may lose some or all of the interest. While some banks give the option for partial withdrawals or flexi FDs, mostly FDs ask us to stick with them for the best results.

-

Risk & Protection

Both savings and FD accounts have low risk and their funds are covered by PIDM (up to RM250,000 per person per bank). Therefore, no matter if we keep our money short-term or save it for years, it remains safe, only if our bank is licensed in Malaysia.

Which One Should We Choose?

If we want to use our money often, keep it safe or park our emergency savings, a savings account will suit us best.

If we don’t plan to withdraw our excess cash for a long period, a fixed deposit will help us make more interest.

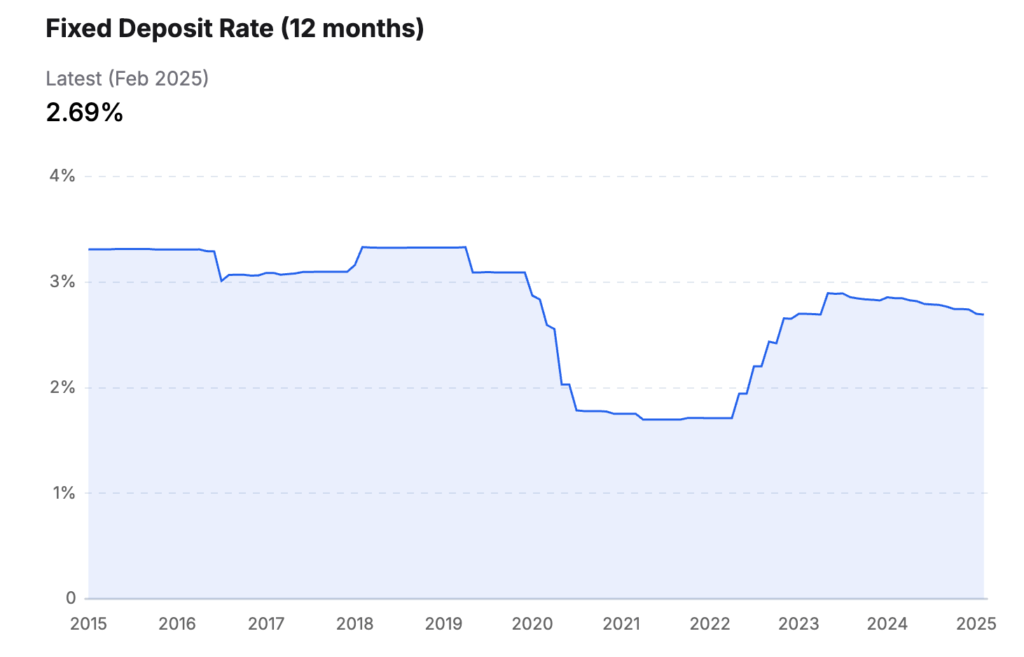

Historical Fixed Deposit (FD) Rates in Malaysia

Source from: data.gov.my

Seeing how FD rates have changed over the past decade allows us to decide when and where we should invest our money. We should look at the trends and understand how they affect our financial planning.

Yearly FD Rates Overview

Here’s a list of Malaysia’s average FD interest rates over the years:

| Year | Interest Rate |

| 2015 | 3.13 |

| 2016 | 3.03 |

| 2017 | 2.92 |

| 2018 | 3.14 |

| 2019 | 2.98 |

| 2020 | 1.95 |

| 2021 | 1.56 |

| 2022 | 1.95 |

| 2023 | 2.63 |

| 2024 | 2.74 |

| 2025 | Projected 2.63 |

Key Trends and Insights

2015–2019: Stability Before the Storm

At this point, FD rates were running near 3% which allowed us to get stable returns. We could feel secure about our savings because we trusted our salaries would be decent.

2020–2021: Pandemic-Induced Decline

The pandemic’s beginning caused the economy to become unpredictable. As a result, the OPR was decreased which caused FD rates to decrease down to 1.56% in 2021. Therefore, our savings did not increase as quickly when we faced these difficulties.

2022–2024: Gradual Recovery

When the economy began to recover, FD rates went up and reached 2.74% by the end of 2024. Even though things are not yet as they were before the pandemic, this recent growth allowed us to see better returns on our money.

2025: Stabilization and Future Outlook

Researchers predict that FD rates will settle at 2.63% in the year 2025. As a result, we can now rely more on stable finances when setting our savings plans.

What This Means for Us

The changes in FD rates in recent years prove that being aware and flexible is important. If we learn about these trends:

- We can make sure that our FD funds are invested when returns are highest.

- · We should invest some money in FDs and others in different types of investments for better balance.

- We should adjust our financial goals to match the current economic situation, so our money helps us.

Tips to Maximize Your FD Returns

People often look for ways to make their money grow and with the correct plan, fixed deposits can give us more benefits than only a safe return. Here are some ways we can best use our FDs in Malaysia these days:

1. Compare, Compare, Compare

Banks may not provide the same FD interest rates for the same investment period. One bank provides 3.50% p.a. for a period of 6 months, whereas the other offers 3.85% p.a. This difference of 0.35% can make a big impact on larger amounts. Shopping around and checking the latest deals is something we always do before we make a decision.

To give an example, if you invest RM50,000 in an FD, earning 3.50% and compare it with another at 3.85%, you’ll earn RM175 more.

2. Look Out for Promotional Rates

To draw in more deposits, banks regularly announce FD campaigns with extra benefits. Most of the time, these promos have special validity periods (such as 4, 7 or 13 months) or ask for new investments. If something grabs our interest, we think about buying it as long as it fits within our budget. Sometimes banks would also offer promotional gifts for new FD placement or credit card sign-up.

3. Go for Shorter Tenures in a Rising Rate Environment

When the expectation is that interest rates will rise, we should put our funds in deposits that have shorter periods (such as 3 or 6 months). By doing this, we get a chance to reinvest our money at higher rates once the rates go up, rather than leaving it in a fixed deposit for years and earning less.

4. Use a Laddering Strategy

This means breaking up our funds and putting them in FDs that mature after 3, 6 or 12 months. Thus, we enjoy steady income, flexibility and decent returns.

As a comparison, putting the whole RM60,000 into a 12-month FD is not the same as dividing it into FDs of RM20,000 each at 3, 6 and 12 months. When the first bond is fully mature, we invest the money again at the new rate and continue.

5. Opt for Flexi or Partial Withdrawal FDs

There are now some banks that allow us to withdraw a part of our fixed deposit without facing any loss of interest. This is useful if we hope to keep our money ready to use and still earn better interest on what we don’t spend.

6. Watch for Fees and Terms

Make sure to look at the small details before you sign. Some FDs ask for a minimum deposit and others include terms that make our funds stay locked at a lower interest rate after the first term ends. We always look for these factors:

- · The minimum amount needed for placement

- There is a penalty for withdrawing your money early.

- · If interest gets paid on a monthly, quarterly or final basis

- When does the loan get paid off and how is the loan account handled?

7. Use Joint or PIDM-Optimized Accounts

As each individual is covered by PIDM for RM250,000 per bank, we are able to split our large deposits into several banks or join them into joint accounts. That way, our money remains safe and still earns interest.

How Do I Open a Fixed Deposit Account?

It is now very simple to set up a fixed deposit (FD) account in Malaysia, whether we do it online or at the bank. The quickest way to begin is this.

Step-by-Step Guide:

1. Choose a Bank

The first step is to check the rates and offers from various banks. Choose the account that suits our requirements and lets us get the best return (tenure, flexibility, lowest deposit).

2. Prepare the Required Documents

We’ll need:

- MyKad or valid ID (passport for non-Malaysians)

- An existing savings or current account with the bank (some banks require this)

- The amount we want to place (usually minimum RM500 to RM1,000)

3. Open Online or Visit a Branch

- Online banking: It is common for banks to let you open an FD from their app or website and it doesn’t involve paperwork.

- Visit the branch, have a chat with a banker and our account will be ready in no time.

4. Choose Your FD Details

We select:

- Tenure (e.g. 1, 3, 6, 12 months or more)

- Placement amount

- Type of FD (conventional or Islamic)

- Whether we want auto-renewal on maturity

5. Place the Funds

Place the money into the FD. If taking out money from savings, it only takes a few quick clicks or a form if you need to do it at the branch.

6. Receive Confirmation

After completion, we’ll receive a certificate or digital receipt to confirm the place, term and the rate of interest. I’ll store this information in our files.

Alternatives to Fixed Deposits (FDs)

Although FDs give you certain returns with little risk, there are other alternatives too. When our main goal is saving for education, retirement or lessening our loan interest, we could try other types of investments for their flexibility, higher returns or tax break.

Let’s look at some wise alternatives to FDs.

1. National Education Savings Scheme (SSPN)

Instead of just FDs, SSPN is a good pick for saving for your child’s education and it gives you additional rewards.

Why we like it:

- Up to RM8,000 in annual tax relief (SSPN Prime)

- Competitive dividends (around 3%–4%)

- Protected by the government (not just PIDM)

If we want to earn interest and save on taxes, this is a good option and it’s useful when we want to get PTPTN loans too.

2. Employees Provident Fund (EPF)

Even though it is called a retirement savings scheme, EPF allows us to earn more money on our extra savings than we would with FDs.

Why we like it:

- Dividend rates around 4%–6% historically

- Tax relief up to RM4,000 per year (on voluntary contributions under EPF i-Saraan/i-Simpanan)

- Compounding works in our favour for long-term savings

Great for long-term savers who don’t mind keeping money locked until retirement (or qualified withdrawals).

3. Amanah Saham Nasional Berhad (ASNB)

Funds from ASNB, for example, Amanah Saham Malaysia, have a unit trust-like structure and provide stable returns each year and they are supported by the government-linked PNB.

Why we like it:

- Dividend yields around 4%–5%

- Low risk, and some funds have capital guarantee

- Accessible to Bumiputera Malaysians (for ASB/ASW)

If we fit the criteria, ASNB may offer us more profit than traditional FDs, with the same sense of security.

4. Flexi Home Loan Account

Even though it’s unique, it’s still quite powerful. With a flexi loan account, we can deposit additional funds to our mortgage to quickly decrease the interest we pay.

Why we like it:

- “Returns” come in the form of interest saved (can be equivalent to 4%–5%)

- Can withdraw anytime (acts like a savings buffer)

- Helps us settle our home loan faster

It is good for anyone who wants to pay off their loans and make better use of surplus cash than keeping it in a low-interest account.

Conclusion

In 2025, fixed deposits (FDs) are still seen as a reliable and easy way for us to increase our savings without taking big risks. Although the rates are not as high as with more risky investments, the safety, security and ease of FDs make them a good choice when things are uncertain.

We’ve covered both the good and bad sides, the kinds of FDs offered locally, how they differ from savings accounts and the way rates have shifted in the last 10 years. No matter if we want our money parked for a short while or want to save for the long term, FDs are a good fit for our financial plan.

Still, they are not designed to fit all situations the same way. We can use SSPN, EPF, ASNB or even flexi loan accounts for our savings, since each one suits different purposes.

The main thing is to remain informed, make a clear plan and be open to flexibility. If we know how to manage our FDs properly and when to look for other options, we can make stronger and more confident financial decisions both in the present and the future.

We should put our money to work in a way that is safe, smart and steady.

FAQ: Common Questions About Fixed Deposits in Malaysia

1. Is FD protected by PIDM?

Yes, PIDM insurance protects fixed deposits for an amount up to RM250,000, including the interest earned, for each individual per bank. It makes us feel comfortable because our money is protected, even if the bank goes through financial problems.

2. Can foreigners open an FD account in Malaysia?

Most banks in Malaysia let non-residents and foreigners open fixed deposits, either in Ringgit or in other currencies. Still, some banks may require extra things such as a larger initial deposit, a valid visa or a savings account in their country. It’s good to go to the bank itself to confirm this.

3. How is FD interest taxed?

Currently, interest generated from fixed deposits in Malaysia does not incur tax for individuals (when the FD is for 12 months or more). For periods under a certain length, the interest could be subject to withholding tax, mostly for corporate accounts or foreign residents.

4. What happens if I withdraw early?

If you take your FD out early, you could lose at least some of the interest you got. Some banks won’t give any interest if you withdraw your money from the FD early. Yet, newer products could give you the chance to partially take out your money with different interest rates. Checking the terms first is important.

You may like

Eczema, Psoriasis, and Allergies in Winter: Understanding Triggers and Treatments

Tip to Benefit Maximally From Your Tow Truck Course

Esports Arena Network Design: 1,000‑Seat LAN & AV Setup (2025 Guide)

Why Jeep Owners Are Switching to Automatic Tops Like eTop

Comparing Demat Account Providers: Which One Should You Choose?

How Anti‑Cheat SDKs Work (Kernel vs User Mode)

NDI vs SRT vs RTMP (2025): Which Stream Protocol Gives You the Lowest Latency for Esports Broadcasts?

New 240Hz 1440p Panels: What Changes for Players

From Chaos to Clarity: How Data Lake Zones Organize the Modern Data Stack